Curious about how our loan software can transform your lending process? Dive into our Live Demo Walkthrough to see every feature in action, from loan application to approval. Discover a seamless, user-friendly experience designed to boost efficiency and customer satisfaction.

Have you ever wondered what it’s really like to use a modern loan management system from start to finish? What if you could experience every feature—before you even sign up? Our Live Demo Walkthrough is your chance to see our loan software in action, step by step, and discover how it can simplify your lending operations, improve accuracy, and delight your customers.

In this in-depth guide, we’ll take you through the full experience—exploring not just the core functionalities, but also the intuitive design, automation tools, and reporting features that set our platform apart. Whether you’re a lender, credit manager, or fintech entrepreneur, this walkthrough will answer your biggest questions and help you envision a smarter way to manage loans.

Why Experience a Live Demo Walkthrough?

Choosing a loan management software is a big decision. You want to be sure it’s easy to use, packed with the right features, and scalable for your business. A Live Demo Walkthrough gives you:

- A hands-on preview of the user interface and workflow

- Insights into automation, compliance, and reporting tools

- Confidence in how the software fits your unique lending process

Unlike static screenshots or generic videos, a live walkthrough lets you interact, ask questions, and see real data flow through the system. It’s the next best thing to a free trial, with expert guidance every step of the way.

What to Expect in Our Loan Software Live Demo Walkthrough

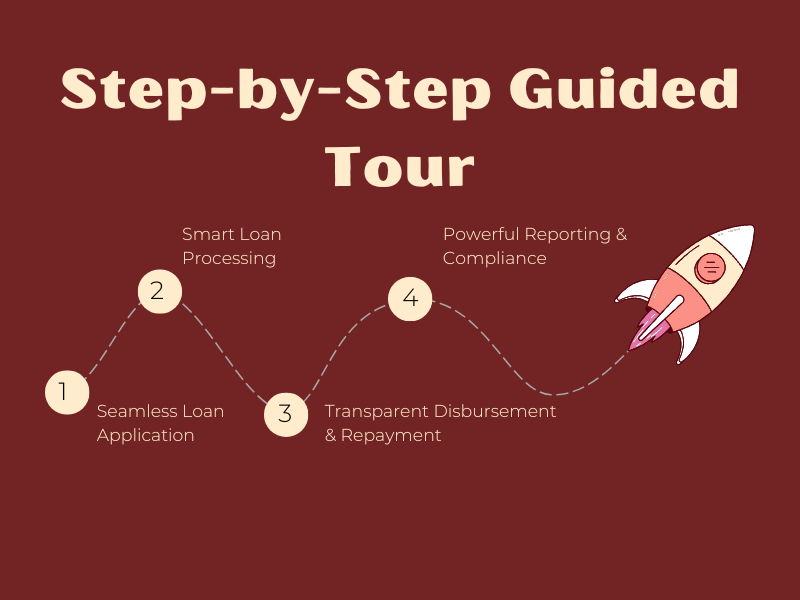

Step-by-Step Guided Tour

Our Live Demo Walkthrough is designed to mirror the real-world journey of a loan application, approval, and management cycle. Here’s what you’ll see:

1. Seamless Loan Application

- User-friendly digital forms: Applicants can fill out loan requests from any device, with real-time validation to minimize errors.

- Document upload & KYC checks: Integrated identity verification ensures compliance and speeds up onboarding.

- Automated notifications: Applicants and staff receive instant updates at every stage.

2. Smart Loan Processing

- Customizable approval workflows: Set rules for automatic or manual review based on loan type, amount, or risk profile.

- Credit score integration: Instantly pull credit data and use built-in scoring models to assess risk.

- Task automation: Routine steps—like document checks or eligibility calculations—are automated for speed and accuracy.

3. Transparent Disbursement & Repayment

- Flexible disbursement options: Send funds directly to the borrower’s account or via third-party payment gateways.

- Repayment scheduling: Create custom repayment plans, set reminders, and automate payment collection.

- Real-time tracking: Monitor outstanding balances, due dates, and payment history with a clear dashboard.

4. Powerful Reporting & Compliance

- Regulatory-ready reports: Generate compliance reports with a single click, tailored to your jurisdiction.

- Custom analytics: Track loan performance, default rates, and portfolio health with interactive charts and filters.

- Audit trails: Every action is logged, ensuring transparency and accountability.

How a Live Demo Walkthrough Drives Better Decision-Making

Interactive demos do more than just showcase features—they help you understand how the software adapts to your workflow and business goals. According to SEO best practices, embedding interactive product demos on your website can increase user engagement, dwell time, and conversion rates. When prospects spend more time exploring a demo, they’re more likely to trust your brand and take the next step.

Key benefits of a Live Demo Walkthrough:

- Increased engagement: Users spend more time on your site, exploring features that matter to them.

- Reduced uncertainty: See exactly how each process works—no surprises after purchase.

- Faster decision cycles: Stakeholders can get answers in real time, speeding up internal approvals.

Optimizing Your Demo Experience for SEO and User Value

To ensure your Live Demo Walkthrough reaches the right audience, it’s crucial to optimize your content for search engines and user intent. Here’s how we do it:

- Keyword-rich content: We naturally incorporate terms like “loan software demo,” “interactive product demo,” and “loan management walkthrough” to capture relevant searches.

- Mobile responsiveness: Our demo works seamlessly on any device, catering to today’s mobile-first audience.

- Fast load times: We use lazy loading and optimized assets, so your demo experience is smooth and frustration-free.

- Schema markup: Enhanced search snippets make your demo stand out in search results, increasing click-through rates.

By following these SEO best practices, your demo isn’t just a sales tool—it becomes a magnet for organic traffic and qualified leads.

Frequently Asked Questions About Our Live Demo Walkthrough

Q: Is the demo interactive or just a video?

A: Our walkthrough is fully interactive, letting you click through each step as if you were a real user.

Q: Can I ask questions during the demo?

A: Absolutely! Our product experts are available to answer your questions and tailor the demo to your needs.

Q: Do I need to install anything?

A: No installation required. The demo runs directly in your browser for maximum convenience.

Ready to See Our Loan Software in Action?

Don’t just imagine a better lending process—experience it for yourself. Book your Live Demo Walkthrough today and discover how our loan software can streamline your operations, boost compliance, and delight your customers from day one.

Take the next step:

- Click the “Book a Live Demo” button below

- Choose a convenient time

- Get ready to see the future of lending, live and in action!

Unlock smarter lending—schedule your Live Demo Walkthrough now and see what you’ve been missing.