Struggling to decide on tech investment? Our detailed ROI Analysis: Is Loan Management Software Worth the Investment? explains how the right system can boost profits, cut risks, and streamline lending operations.

Running a lending business today means juggling numbers, deadlines, and collections—with zero room for error. Many lenders, from NBFCs to microfinance institutions, face a common challenge: managing a growing loan portfolio without drowning in manual tasks. At some point, the question arises—is loan management software worth the investment? Does the upfront expense translate into meaningful financial returns? This blog dives deep into that very question, providing practical insights and data-driven analysis.

Within the first 100 words, it’s clear: Loan management software is not just a digital trend—it’s an essential business investment that can transform operational efficiency, reduce risk, and accelerate growth.

What is Loan Management Software and Why Does it Matter?

Loan management software (LMS) is a tool designed to automate the complete loan lifecycle—from application and approval to EMI tracking and collection. It helps lenders manage accounts, payments, and compliance all within a single platform, replacing error-prone spreadsheets and manual workflows.

The financial services industry is evolving fast. Borrowers demand faster disbursals, regulators expect full compliance, and competition is fiercer than ever. Traditional manual processes just can’t keep up. That’s where LMS becomes a game changer.

Breaking Down the ROI: What You Gain Beyond the Price Tag

Evaluating the ROI on loan management software means looking at direct costs saved and indirect gains earned. Here are the core areas where the ROI shines:

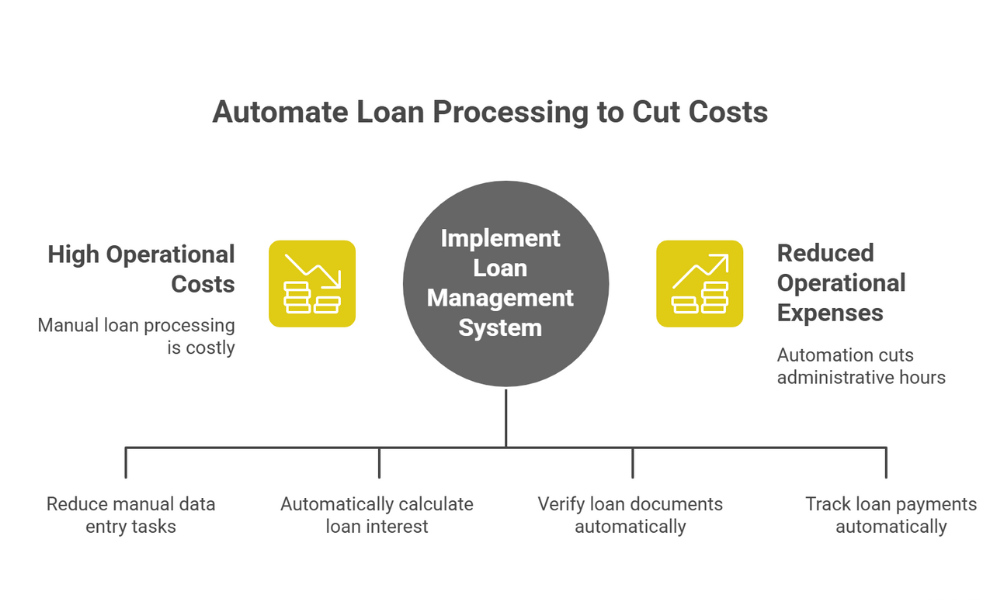

1. Slashing Operational Costs with Automation

Manual loan processing involves many repetitive, low-value tasks: data entry, interest calculation, document verification, and payment tracking. Each of these requires time—and labor costs add up quickly.

By automating these processes, LMS frees your team to focus on more strategic functions instead of routine admin. Some studies show lenders can cut administrative hours by up to 50%, directly reducing operational expenses.

Imagine your team spends 25 hours weekly on back-office tasks at a fixed labor cost. Automating even half that work saves hundreds of hours annually worth serious salary dollars. The system also reduces human errors which can otherwise lead to costly loan miscalculations or compliance risks.

2. Lowering Risk with Smarter Lending Decisions

The risk of loan defaults or delayed payments can sink your lending business. Loan management software integrates credit bureau data and uses risk scoring to flag risky applicants upfront. This lowers Non-Performing Asset (NPA) ratios and protects your capital.

A conservative 1-2% drop-in default rates can mean massive savings and improved liquidity. Even better, automated tracking and reminders enhance timely repayments, further reducing overdue accounts.

3. Accelerating Revenue Through Faster Loan Processing

Speed is an undeniable advantage in lending. With a seamless loan origination system, approval and disbursal times shrink from days to minutes. Faster TAT (Turnaround Time) means you can serve more borrowers with the same resources, increasing loan volumes and interest income.

Additionally, digital self-service portals offer borrowers real-time access to account details, payment schedules, and even instant top-ups—improving satisfaction and retention.

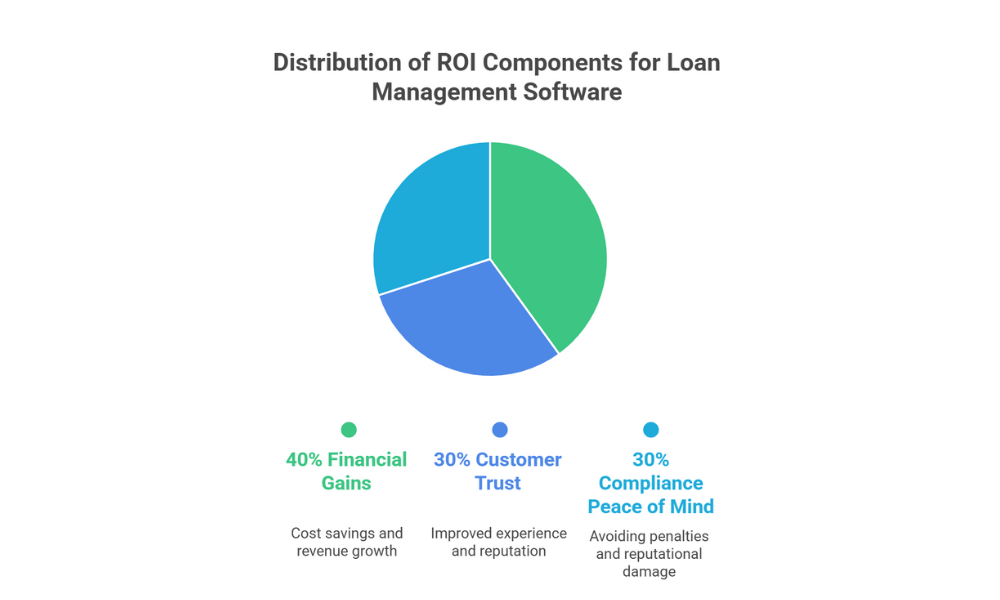

The Intangible ROI: Customer Trust and Compliance Peace of Mind

Not all ROI fits neatly into financial spreadsheets. The value of improved customer experience and compliance also matters deeply:

- Customer experience: Smooth digital onboarding, transparent communication, and easy online payments build trust and reputation. Happy customers repay more reliably and bring referrals—fueling organic growth.

- Regulatory compliance: Lending software helps automate audit trails, reporting, and adherence to RBI or local laws. Avoiding compliance penalties and reputational damage is a powerful ROI driver.

Is It Worth It? Comparing Investment vs. Returns

Loan management software costs vary by feature set and scale but generally represent a small percentage of your loan book size. Let’s review a quick comparison:

| Investment Aspect | Impact on ROI |

| Initial Setup & Subscription Cost | Often recouped within 6-12 months via savings and efficiency |

| Labor Expense Reduction | Significant annual operating cost saving |

| Improved Risk Management | Lower NPA and capital preservation |

| Revenue Growth | Higher loan volume through rapid processing |

| Compliance and Customer Trust | Avoids fines and boosts customer loyalty |

Most lenders discover that software pays for itself within a year, especially when factoring indirect benefits.

Conclusion

So, is loan management software worth the investment? If increasing efficiency, reducing risk, and growing your revenue matter—you can’t afford to say no. The financial and strategic advantages far exceed the upfront cost.

It’s time to move from manual chaos to streamlined success. By investing in a capable loan management system, you position your business not just for survival, but for scalable growth in a competitive market.

Ready to modernize your lending process and calculate YOUR ROI? Contact us today to explore the perfect loan management solution tailored for your business.