Discover how loan automation improves borrower experience by offering faster approvals, personalized communication, and transparent processes. See how technology is reshaping lending for the better and delighting customers.

How Loan Automation Radically Improves the Borrower Experience

Remember the last time you heard someone describe their loan application process as “delightful” or “effortless”? Probably never. For decades, borrowing has been synonymous with towering stacks of paperwork, long, anxious waits, and a frustrating lack of communication. It often feels like you’re sending your financial hopes into a black box, waiting for a verdict. But what if we could change that narrative? The good news is, we can. This article explores how loan automation improves borrower experience, turning a once-dreaded task into a smooth, transparent, and surprisingly positive journey.

At Grin Technologies, we believe that the future of lending isn’t just about numbers and algorithms; it’s about people. It’s about creating a system that respects the borrower’s time, reduces their anxiety, and builds trust from the very first click. Let’s dive into how automation is making that vision a reality.

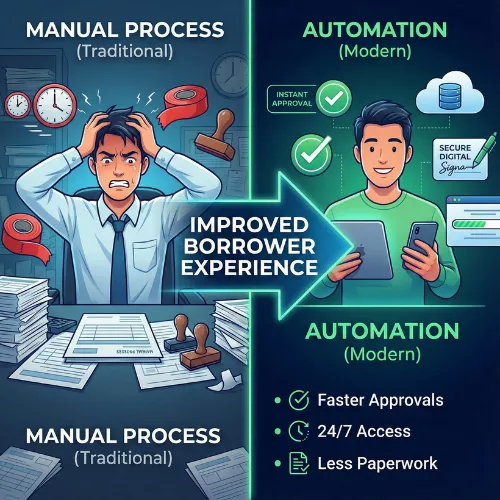

The Old Way vs. The New: Why Traditional Lending Fails the Modern Borrower

Before we can appreciate the solution, we need to understand the problem. The traditional lending model was built for a different era. It often involves:

- Manual Paperwork: Endless forms requiring the same information over and over.

- In-Person Visits: Forcing borrowers to take time off work to visit a branch.

- Long Approval Cycles: Days, or even weeks, of uncertainty while files are manually reviewed.

- Opaque Processes: Little to no visibility into the application’s status.

- Human Error: Mistakes in data entry or calculations that can delay or derail the entire process.

This friction-filled journey doesn’t just waste time; it creates a negative customer experience that can erode trust and loyalty before the relationship even begins. Modern borrowers, accustomed to the instant gratification of the digital world, expect and deserve better.

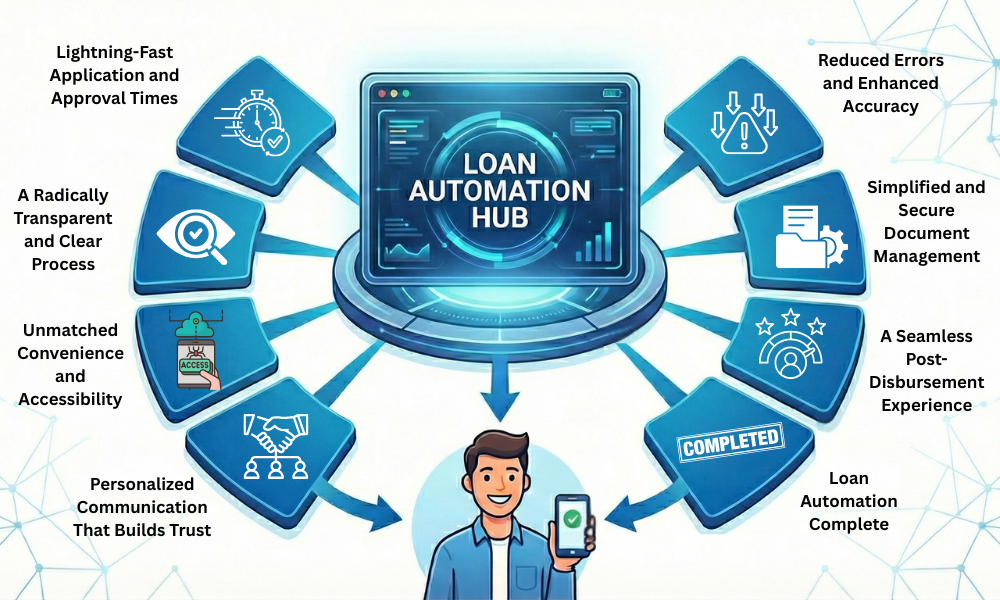

7 Key Ways Loan Automation Improves Borrower Experience

Loan automation isn’t about replacing humans with strong. It’s about using technology to handle the repetitive, time-consuming tasks so that human experts can focus on what they do best: helping people. Here’s how it transforms the experience.

1. Lightning-Fast Application and Approval Times

The single biggest source of anxiety for borrowers is the waiting game. Loan automation demolishes this pain point.

- 24/7 Accessibility: Borrowers can apply for a loan from the comfort of their home, at any time of day, using a laptop or smartphone.

- Instant Data Verification: Technologies like eKYC (Electronic Know Your Customer) and automated bank statement analysis verify a borrower’s identity and financial health in minutes, not days.

- AI-Powered Decisions: Sophisticated algorithms can assess creditworthiness based on thousands of data points, providing an instant pre-approval or decision. This shift from weeks to minutes is a game-changer for customer satisfaction.

2. A Radically Transparent and Clear Process

Automation replaces uncertainty with clarity. Instead of wondering what’s happening, borrowers are kept in the loop at every stage. A strong loan management system can provide:

- Real-time status updates via a customer portal, SMS, or email.

- A clear checklist of required documents and their submission status.

- Automated notifications when the application moves to the next stage.

This transparency eliminates anxiety and empowers the borrower, making them feel in control of the process.

3. Unmatched Convenience and Accessibility

Life is busy. Automation respects that by bringing the entire lending process to the borrower’s fingertips. They no longer need to align their schedule with banking hours. Whether they are at home, in the office, or on the go, they can complete their application, upload documents, and check their status with just a few clicks. This mobile-first approach is no longer a luxury; it’s a core expectation.

4. Personalized Communication That Builds Trust

Generic, one-size-fits-all communication feels impersonal. Automation allows lenders to deliver personalized messages at scale.

- Tailored Reminders: Automated but friendly reminders can prompt a borrower to upload a missing document or complete a step.

- Customized Offers: By analyzing borrower data, automation can help present loan products and terms that are genuinely relevant to their needs.

This proactive and personalized approach shows the borrower that they are seen as an individual, not just an application number, fostering a stronger, more trusting relationship.

5. Reduced Errors and Enhanced Accuracy

To err is human, but in lending, errors can be costly and frustrating. Automation minimizes the risk of manual data entry mistakes, miscalculations, or misplaced documents. By standardizing the data collection and evaluation process, it ensures that every application is assessed consistently and fairly, which builds immense trust and credibility from the borrower’s perspective.

6. Simplified and Secure Document Management

The era of photocopying and physically signing stacks of paper is over. Modern loan automation platforms offer:

- Digital Document Uploads: Borrowers can easily upload photos or scans of their documents from their phones.

- e-Signatures: Legally binding digital signatures streamline the final stages of the agreement.

- Secure Storage: All sensitive information is encrypted and stored securely, giving borrowers peace of mind that their data is protected.

7. A Seamless Post-Disbursement Experience

A great borrower experience doesn’t end once the loan is disbursed. Automation continues to add value throughout the life of the loan. With a powerful loan management system, borrowers get access to a self-service portal where they can:

- View their loan statements and repayment history.

- Set up automated payments through mechanisms like e-NACH.

- Receive automated EMI reminders to avoid late fees.

This empowers borrowers to manage their finances effectively and reduces the operational load on the lender.

The Future of Lending is Here, and It’s Customer-Centric

Ultimately, the reason loan automation improves borrower experience so dramatically is that it realigns the entire process around the customer’s needs. It replaces waiting with speed, confusion with clarity, and inconvenience with control. By embracing this technology, lending institutions are not just optimizing their operations; they are building a foundation of trust and loyalty that will pay dividends for years to come.

The world has gone digital, and your borrowers are already there. It’s time for the lending industry to meet them.

Ready to transform your lending process and delight your borrowers? Contact Grin Technologies today for a demo and see how our advanced loan automation solutions can revolutionize your business.

1 reply on “How Loan Automation Improves Borrower Experience | Grin Technologies”

[…] Loan approval automation is one of the biggest contributors to reduced processing time. […]