Multi branch loan management helps large NBFCs streamline operations, manage multiple products, ensure compliance, and scale efficiently with centralized loan systems.

Multi-Branch Loan Operations

Managing a large NBFC today is no longer just about disbursing loans—it’s about handling scale, speed, compliance, and complexity across locations and products. As NBFCs expand geographically and diversify their offerings, multi branch loan management becomes a critical foundation for sustainable growth.

Within the first few years of expansion, many NBFCs operate across dozens or even hundreds of branches while offering personal loans, business loans, gold loans, consumer finance, and group lending. Without the right systems, this growth can quickly turn into operational chaos. This is where centralized, technology-driven loan management plays a decisive role.

Operational Complexity

Large NBFCs face a unique set of challenges when operating across multiple branches:

- Disparate processes across locations

- Manual reconciliation between branch and head office

- Limited visibility into portfolio performance

- Delays in approvals and disbursements

- Inconsistent customer experience

As branch count increases, managing data silos becomes nearly impossible. Each location may follow slightly different workflows, leading to inefficiencies and risk exposure. Effective multi branch loan management addresses this by standardizing operations while still allowing local flexibility.

Operational complexity multiplies further when NBFCs introduce new loan products. Different interest structures, tenures, repayment schedules, and risk models demand a system that can handle diversity without increasing overhead.

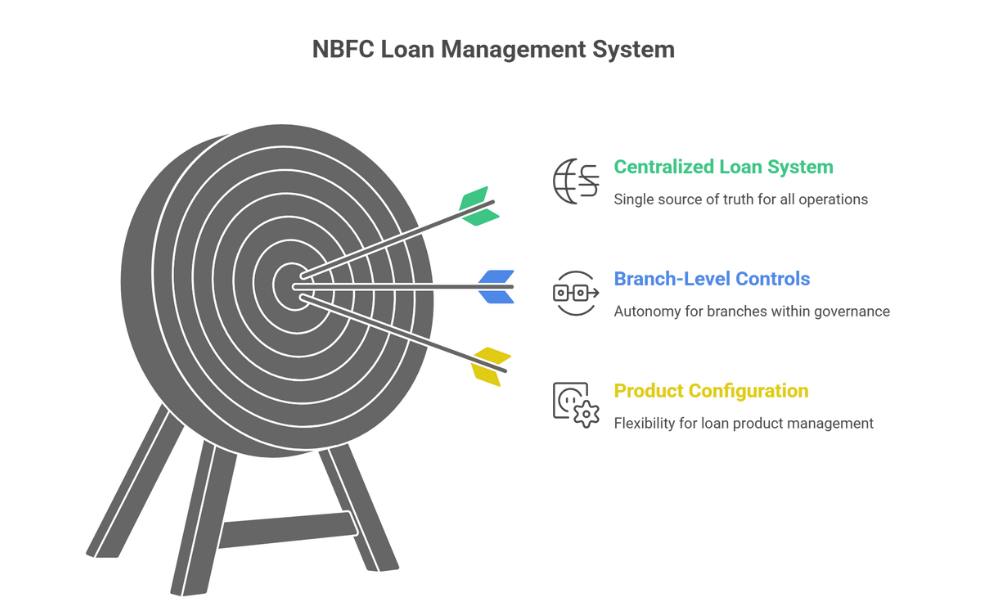

Centralized Loan Systems

A centralized loan management system acts as a single source of truth for the entire organization. It connects branches, products, and teams under one unified platform, enabling real-time decision-making.

With centralized architecture, NBFC operations benefit from:

- Real-time portfolio monitoring

- Faster credit decisions

- Unified customer data

- Automated workflows

- Reduced operational risk

For growing NBFCs, centralized systems are not just a technology upgrade—they are a strategic necessity.

Branch-Level Controls

While centralization is key, branches still need autonomy to function efficiently. Modern multi branch loan management platforms allow NBFCs to define branch-level controls without compromising governance.

These controls include:

- Role-based access for branch staff

- Branch-wise approval limits

- Location-specific workflows

- Performance tracking at branch level

Such controls ensure accountability while giving management complete visibility into branch operations. Head offices can track disbursements, collections, delinquency trends, and staff productivity across all branches in real time.

Product Configuration

As NBFCs scale, product innovation becomes a competitive advantage. A robust multi product lending software enables lenders to launch, modify, and manage loan products without heavy IT dependency.

Key capabilities include:

- Configurable interest rates and fee structures

- Flexible repayment schedules

- Product-specific eligibility criteria

- Automated EMI calculations

This flexibility allows NBFCs to respond quickly to market demand while maintaining operational consistency. With the right system, adding a new loan product becomes a configuration task—not a development project.

Compliance & Reporting

Regulatory compliance is a non-negotiable aspect of NBFC operations. RBI guidelines require accurate reporting, audit trails, and risk monitoring across all branches and products.

Centralized multi branch loan management systems simplify compliance by:

- Automating regulatory reports

- Maintaining audit-ready data logs

- Ensuring uniform policy enforcement

- Enabling real-time risk assessment

Advanced reporting dashboards provide insights into portfolio health, NPA trends, and collection efficiency. This not only supports compliance but also empowers leadership with data-driven decision-making.

Why Technology-Driven NBFC Operations Matter

In today’s lending ecosystem, manual processes and fragmented systems limit growth. Large NBFCs need scalable infrastructure that supports expansion without increasing complexity.

A modern loan management platform brings together:

- Centralized control

- Branch-level flexibility

- Multi-product scalability

- Regulatory compliance

Together, these elements form the backbone of efficient NBFC operations in a competitive and regulated environment.

Conclusion: Scaling with Confidence

Growth should not come at the cost of control. For large NBFCs, investing in multi branch loan management is about future-proofing the business. With centralized systems, configurable products, and strong compliance frameworks, NBFCs can scale confidently while delivering consistent customer experiences.

If your organization is expanding across branches or launching multiple loan products, now is the time to rethink your loan management strategy.

Call to Action:

Looking to streamline multi-branch operations and manage multiple loan products seamlessly? Explore a centralized loan management solution designed specifically for growing NBFCs and unlock operational efficiency at scale.