Discover how API-driven lending is revolutionizing loan management by enhancing efficiency, accuracy, and customer experience. Learn why APIs are shaping the future of financial lending.

Introduction: Embracing API-Driven Lending for Smarter Loan Management

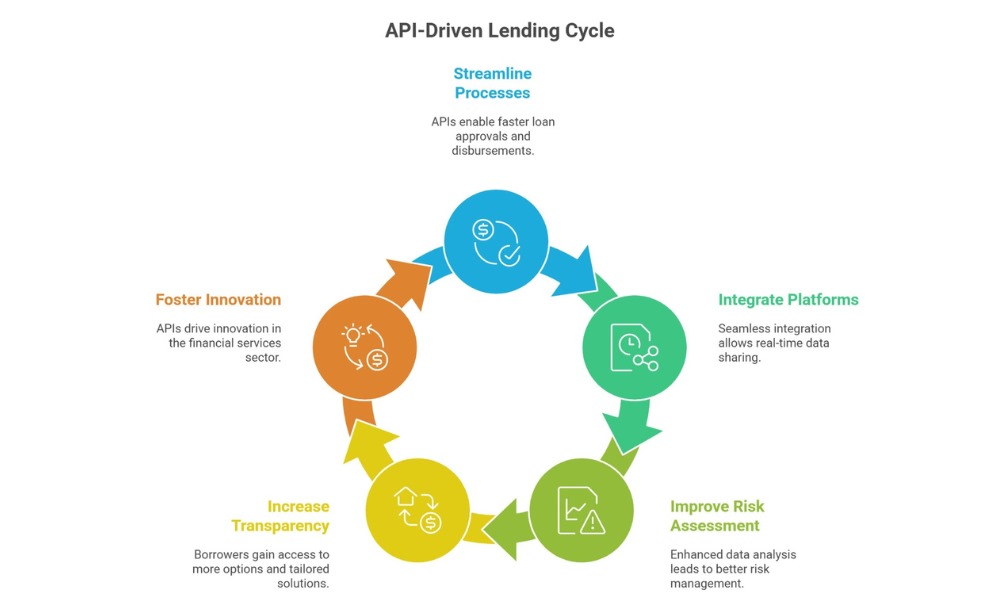

API-driven lending is rapidly transforming the loan management industry by enabling seamless automation, real-time data access, and streamlined processes. This innovative approach uses Application Programming Interfaces (APIs) to connect different financial services and data sources, allowing lenders to make faster, smarter, and more personalized lending decisions. As the demand for faster loan approvals and superior customer experiences increases, API-driven lending emerges as the future-ready solution optimizing every stage of the loan lifecycle. Whether you are a fintech entrepreneur or a loan service provider, understanding API-driven lending is essential for scaling efficiently in today’s competitive market.

What is API-Driven Lending?

API-driven lending refers to the integration of APIs into lending systems to automate workflows, enable real-time data exchange, and deliver enhanced borrower experiences. APIs act as digital bridges, connecting lending platforms with third-party services such as credit bureaus, banking institutions, identity verification tools, and payment gateways. This interconnected ecosystem enables financial institutions to collect and analyze comprehensive borrower information swiftly and accurately.

Key APIs in Loan Management

- Credit Scoring APIs: Fetch real-time credit reports to evaluate borrower risk.

- KYC and Identity Verification APIs: Automate customer onboarding with compliant verification.

- Banking Data APIs: Access real-time transaction and account information for better financial insights.

- Payment and e-Mandate APIs: Facilitate digital loan disbursals and automated repayments.

Benefits of API-Driven Lending

Faster and More Accurate Loan Processing

APIs drastically reduce manual tasks like data entry and document verification, speeding up loan approval processes from hours or days to just minutes. Automated data collection from multiple sources ensures that credit decisions are based on up-to-date, accurate financial records. For example, real-time banking data access allows lenders to assess a borrower’s financial health comprehensively, reducing defaults and improving portfolio quality.

Enhanced Customer Experience

Borrowers enjoy a frictionless, transparent loan application journey with instant eligibility checks, e-signatures, and real-time updates on their loan status. APIs enable a tailored loan offering based on a borrower’s unique financial profile, increasing loan acceptance rates and customer satisfaction.

Operational Efficiency and Cost Savings

Lenders save significant resources by automating compliance reporting, risk assessments, and underwriting through APIs. This automation minimizes human error, lowers operational costs, and allows quicker scalability without proportional infrastructure investment.

Challenges and Considerations for API Integration in Lending

Security and Data Privacy

With sensitive financial data flowing through APIs, strong security protocols and compliance with regulations such as KYC (Know Your Customer) and AML (Anti Money Laundering) are critical. API-driven lending platforms must employ end-to-end encryption and frequent audits to safeguard data.

Integration Complexity

Integrating various APIs seamlessly into existing loan management systems poses technical challenges. Choosing standardized, well-documented APIs reduces development time and offers flexibility for future technology upgrades.

Regulatory Compliance

API lenders must continuously monitor changes in financial regulations to ensure their digital lending processes remain compliant, especially in different jurisdictions.

Future Trends in API-Driven Lending

Artificial Intelligence (AI) and Machine Learning Integration

By combining APIs with AI algorithms, lenders can enhance credit scoring accuracy, fraud detection, and personalized loan recommendations, further revolutionizing the lending experience.

Embedded Finance and Open Banking

Open APIs unlock opportunities for lenders to embed loan products directly into non-financial platforms, reaching customers in their everyday digital environments while leveraging broader financial data.

Real-Time Loan Ecosystem

API-driven platforms are moving towards ecosystems where borrowers, lenders, payment providers, and credit bureaus interact in real time, fostering transparency and swift dispute resolution.

Call to Action: Embrace API-Driven Lending Now

The future of loan management is undeniably API-driven. Lenders seeking competitive advantage must invest in API integration to optimize loan workflows, enhance decision-making, and deliver seamless borrower experiences. Whether you are updating your fintech platform or launching a new loan service, adopting API-driven lending technologies is essential to thrive in the evolving financial landscape. Start exploring API solutions today to unlock faster, smarter, and more profitable lending.