Discover the real challenges we faced and the innovative solutions we built while developing our Loan Management Platform. Explore behind-the-scenes insights into API integration, EMI automation, data security, and UX design that shaped a next-gen lending solution.

Building a Loan Management Platform is more than just coding software — it’s about understanding the complexities of lending, compliance, user behavior, and financial workflows. When we embarked on building our platform, we wanted to create a product that simplified loan operations, automated EMI collections, reduced defaults, and improved the borrower experience. But the journey wasn’t easy.

From handling regulatory compliance and integrating complex APIs to ensuring data security and managing scalability, we encountered several challenges. In this blog, we’ll take you behind the scenes to share how we tackled these issues and turned obstacles into opportunities.

Understanding the Goal Behind Our Loan Management Platform

Our vision was clear — to design a digital lending software solution that automated the end-to-end loan lifecycle. This included loan origination, credit verification, EMI scheduling, repayment tracking, and collection management.

But the real challenge lay in bringing all these pieces together seamlessly while keeping the user journey smooth and compliant with various financial regulations such as RBI guidelines, NBFC protocols, and data privacy norms.

The Biggest Challenges We Faced

Building a loan management system for modern lenders meant solving multiple hidden problems that most users never see. Below are some of the major hurdles we overcame during development.

1. Managing Complex Loan Workflows

One of the primary challenges was enabling lenders to handle multiple loan products — such as personal, gold, vehicle, or business loans — under one platform. Each product had a different interest structure, tenure, and repayment pattern.

To solve this, we created a modular loan engine that allowed customized configurations. Lenders could set flexible interest rates, auto-calculate EMIs, and set up real-time repayment schedules. This adaptability made our platform scalable for NBFCs, microfinance firms, and fintech startups alike.

2. Ensuring Data Security and Compliance

Handling sensitive borrower data is one of the most critical aspects of any loan management platform. We had to ensure that every data point — from personal details to payment information — was stored, processed, and transmitted securely.

We implemented end-to-end encryption, multi-factor authentication, and role-based access control to protect data. Additionally, our compliance framework was designed to align with RBI and PCI DSS standards to ensure full regulatory compliance in lending.

3. API Integration Across Multiple Systems

Fintech ecosystems are dependent on APIs — from credit bureaus to payment gateways and KYC verification providers. The biggest challenge was to integrate multiple third-party APIs smoothly and ensure they communicated effectively within the system.

Our development team built a unified middleware layer that acted as a central hub for all integrations. It ensured real-time data flow between CRIF, CIBIL, government verification systems, and payment partners like Razorpay or Cashfree, Eazy Collect.

This not only reduced API failures but also improved loan disbursement speed and accuracy in borrower profiling.

4. Automating EMI Collection Processes

EMI collection was one of the most time-consuming parts of loan management for NBFCs. Late payments, manual reconciliations, and customer follow-ups made the process inefficient.

We introduced automated EMI reminders, digital payment links, and auto-debit features (eNACH, UPI AutoPay) that provided borrowers with easy payment options and reduced defaults significantly. Automated reconciliation matched every transaction against loan accounts in real time, minimizing errors.

This move not only simplified the backend operations but also enhanced the borrower’s experience, encouraging timely repayments.

5. Designing a Seamless User Experience (UX)

Our early prototypes proved that lenders struggled with bloated interfaces filled with unnecessary data. Borrowers, too, faced difficulties in understanding loan status and repayment progress.

We addressed this by focusing heavily on UI/UX design for fintech software. Through continuous user feedback sessions, we developed dashboards that displayed all loan metrics at a glance — overdue amounts, upcoming EMIs, collection reports, and borrower histories.

The design was kept intuitive enough for teams across customer service, accounting, and operations to collaborate easily.

6. Maintaining Scalability and High Performance

As our clients grew and onboarded more borrowers, the system had to manage increasing data loads and transaction volumes efficiently. We chose a cloud-native architecture, enabling our platform to scale dynamically based on usage.

Using distributed databases and microservices-based structure ensured that performance never dropped, even when processing thousands of transactions simultaneously.

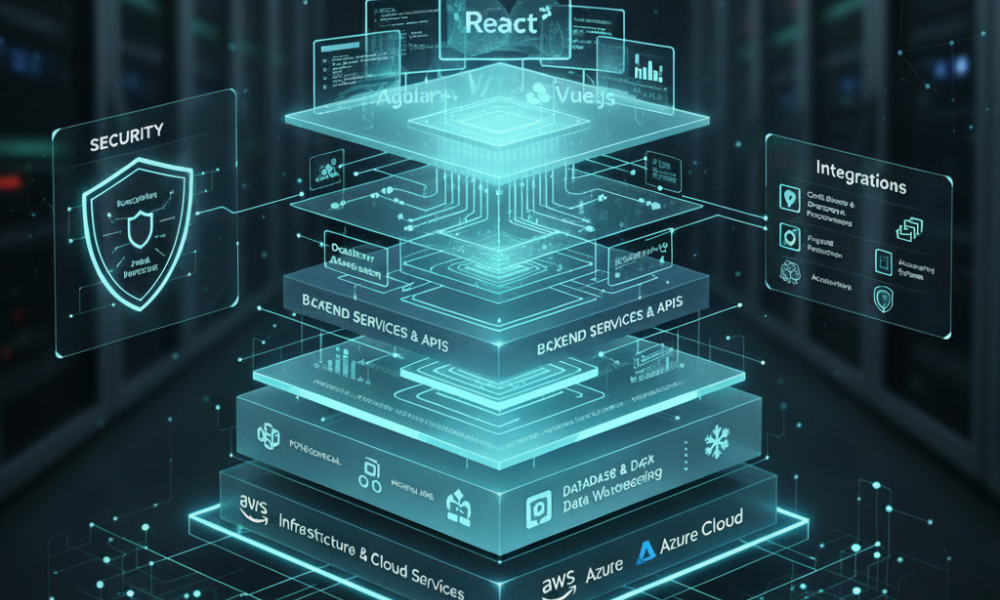

Behind the Technology Stack

Our loan management platform architecture was designed with stability, speed, and security as pillars. Using cutting-edge technologies helped us deliver a robust, future-ready solution.

- Backend: Node.js and Python for API management and logic execution.

- Frontend: React.js for a responsive interface.

- Database: MongoDB and PostgreSQL for structured and unstructured data.

- Cloud: AWS and Azure for hosting and scalability.

- Security: AES encryption, JWT authentication, and firewall configuration.

This stack offered a balance between performance, reliability, and maintainability — essential for any enterprise-grade lending management software.

Key Lessons Learned During Development

Every challenge taught us something valuable:

- Collaboration beats complexity — Engaging both technical and financial experts early helped align product features with real-world lending use cases.

- User feedback is gold — Listening to lenders helped improve usability and reduce friction.

- Security is not optional — Building compliance-first from day one saved rework and ensured trust from partners.

- Automation improves efficiency — Every process, from loan approval to EMI reminders, benefited from smart automation.

Conclusion: Building What Lenders Truly Need

Behind every successful Loan Management Platform, there’s a lot of innovation, experimentation, and problem-solving. From EMI automation to advanced analytics, each module was crafted to make lending simpler, faster, and smarter.

If you’re an NBFC, microfinance institution, or fintech startup looking to automate your lending operations, our Loan Management System can streamline your entire process — from loan origination to collection.

Ready to scale your lending business with intelligent automation?

Contact us today to schedule a personalized demo and explore how our platform can transform your operations.