How a Fintech Startup Streamlined Its Loan Operations

Discover how a fintech startup streamlined its loan operations using automation, digital workflows, and data-driven tools. This case study breaks down key challenges, solutions, and measurable outcomes..

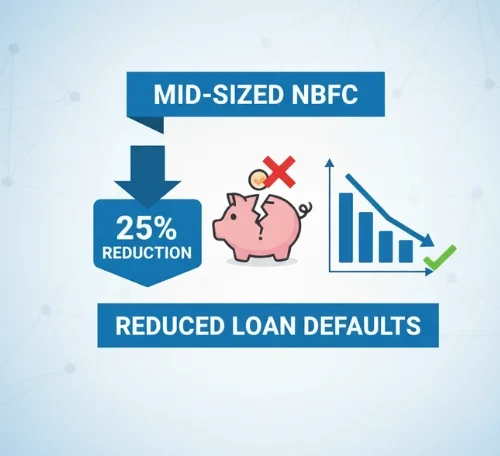

How a Mid-Sized NBFC Reduced Loan Defaults by 25%: A Loan Default Case Study In 2025

Discover how a mid-sized NBFC cut loan defaults by 25% in this detailed loan default case study. Learn their strategies using loan management software, predictive analytics, and..

How One Lender Scaled to 50,000 Loans—And How You Can Too 2025

How One Lender Scaled to 50,000 Loans—And How You Can Too Below is your blog with selective emphasis added. I’ve bolded key benefits, outcomes, and feature phrases..

Top 5 Reasons Our Clients Stay with Grin Technologies Long-Term 2025

Discover the 5 reasons our clients stay with Grin Technologies long-term. Learn how our customer-first approach, innovative solutions, and smooth support drive loyalty and growth for businesses..

🚀How a Smart Loan Platform Boosted ROI for an Indian NBFC in 2025

Discover how a modern loan management platform transformed ROI for an Indian NBFC. Learn about smart lending technologies, regulatory compliance, cost savings, and real-world results in this..

Awards, Achievements & Milestones: Why Clients Trust Us with Fintech Apps 2025

Discover why Grin Technologies is the trusted partner for fintech app and software development. Explore our awards, achievements, and milestones—and see why clients choose us for secure,..

Fintech Leader: Lender Case Study 2025

Discover how a legacy lender transformation led to fintech innovation. Learn about digital lending, modern banking technology, and the journey from legacy systems to fintech leadership.The financial..

Case Study: How Grin Technologies Helped Improve Their Loan Management Process

The Challenge: Inefficient Loan Management Systems: In the fast-paced financial sector, the efficiency of loan management systems can make or break a company. Many financial institutions struggle..

Enhancing Customer Experience in the Financial Sector with Technology.

Leveraging AI for Personalized Banking Experiences :- Technology has paved the way for personalized banking experiences through the use of artificial intelligence (AI). AI-powered chatbots and virtual..