Loan Software Migration: A Step-by-Step Guide for Lenders and NBFCs

A complete step-by-step guide to loan software migration, covering migration planning, data migration, validation & testing, downtime control, and a post-migration checklist for seamless fintech implementation. Introduction..

When Loan Software Fails: Why It’s Time to Upgrade Loan Management Software 2026

Is it time to upgrade loan management software? Discover the clear signs your NBFC has outgrown its current system, including legacy loan system issues, compliance risks, and..

Loan Portfolio Management 2026: Risk, Growth & Performance Insights

In modern lending, success is no longer defined by how many loans you issue it’s defined by how well you manage them. A growing portfolio without visibility..

How Loan Process Automation Reduces Loan Processing Time by 60% in 20266

Loan Process Automation Loan process automation has become a critical driver of growth for banks, NBFCs, and fintech companies. In a world where customers expect instant approvals..

Multi branch & Multi product Loan Management For Large Nbfcs 2026

Multi branch loan management helps large NBFCs streamline operations, manage multiple products, ensure compliance, and scale efficiently with centralized loan systems. Multi-Branch Loan Operations Managing a large..

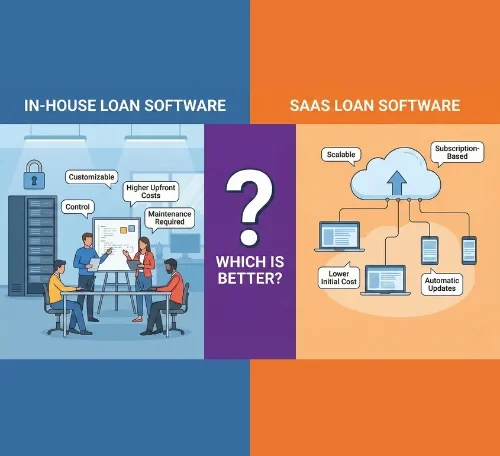

In House vs SaaS Loan Software Which Is Better? In 2026

Explore the detailed comparison between in-house loan management systems and SaaS loan software. Learn which option suits your NBFC, MFI, or lending business best in terms of..

The Role of Machine Learning in Predicting Loan Defaults In 2026

Discover how the role of machine learning in predicting loan defaults is revolutionizing credit risk assessment. Learn key algorithms, real-world benefits, and strategies for lenders to reduce..

Why Lenders Are Moving Toward No-Code Loan Platforms in 2026

Discover why lenders are moving toward no‑code loan platforms to launch products faster, cut IT costs, and scale digital lending with less risk. If you work in..

API-Driven Lending: The Future of Loan Management In 2026

Discover how API-driven lending is revolutionizing loan management by enhancing efficiency, accuracy, and customer experience. Learn why APIs are shaping the future of financial lending. Introduction: Embracing..

How to Choose the Right Loan Management Software for Your Business 2025

If you run a lending business, NBFC, fintech startup, or even offer in-house EMIs, choosing the right loan management software for your business can literally make or..