Scalable loan management software enables NBFCs and fintech lenders to handle high-volume lending efficiently through automation, optimized system architecture, and robust fintech infrastructure.

Imagine approving loans faster than ever—only to realize your systems can’t keep up with repayments, compliance reporting, or portfolio monitoring.

This is the reality many fast-growing NBFCs face today.

High demand is no longer the challenge. Managing that demand at scale is.

In modern lending, growth does not fail because of lack of customers—it fails because of weak systems. That is why scalable loan management software has become the foundation of sustainable NBFC growth. It allows lenders to handle high-volume lending efficiently, stay compliant, and deliver consistent borrower experiences—even as portfolios grow into millions of accounts.

This blog goes beyond theory. It explains how scalable systems work, why they matter, and what NBFCs should look for when building future-ready fintech infrastructure.

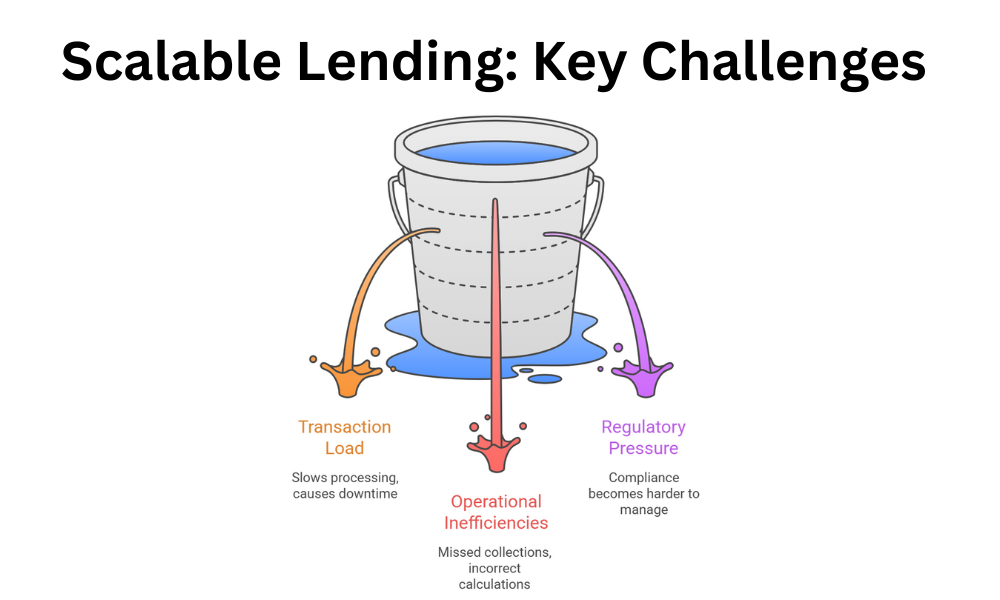

High-Volume Lending Challenges

As NBFCs expand across products, customer segments, and geographies, lending volumes increase exponentially. However, operational complexity often grows even faster.

1. Transaction Load & System Performance

High-volume lending means:

- Millions of repayment transactions

- Concurrent user access

- Real-time ledger updates

- Daily interest accruals

Without scalable systems, performance bottlenecks lead to slow processing, system downtime, and poor borrower experience.

2. Operational Inefficiencies

Manual reconciliation, spreadsheet-based tracking, and fragmented systems create delays, errors, and operational risk. At scale, even a small inefficiency can result in:

- Missed collections

- Incorrect interest calculations

- Compliance violations

3. Regulatory & Compliance Pressure

NBFCs operate under strict regulatory oversight. As loan volumes increase, compliance becomes harder to manage without automation—especially for:

- Audit trails

- Data security

- Reporting to regulators

According to the Reserve Bank of India (RBI), strong digital infrastructure is essential for maintaining financial stability in rapidly growing NBFCs.

Automation & System Architecture

The backbone of any scalable loan management software lies in automation and intelligent system architecture. This is what enables lenders to grow without proportionally increasing operational costs.

Automated Loan Lifecycle Management

Modern platforms automate the entire loan lifecycle:

- Loan origination

- EMI scheduling

- Interest calculation

- Collections & delinquency tracking

- Closures and renewals

Automation ensures consistency, accuracy, and speed—key requirements for high-volume lending environments.

Performance Optimization

Horizontal & Vertical Scalability

Scalable loan systems are built to handle growth through:

- Horizontal scaling (adding servers during peak loads)

- Vertical scaling (enhancing system capacity without downtime)

Cloud-native platforms, in particular, allow NBFCs to scale instantly during high transaction periods such as month-end collections.

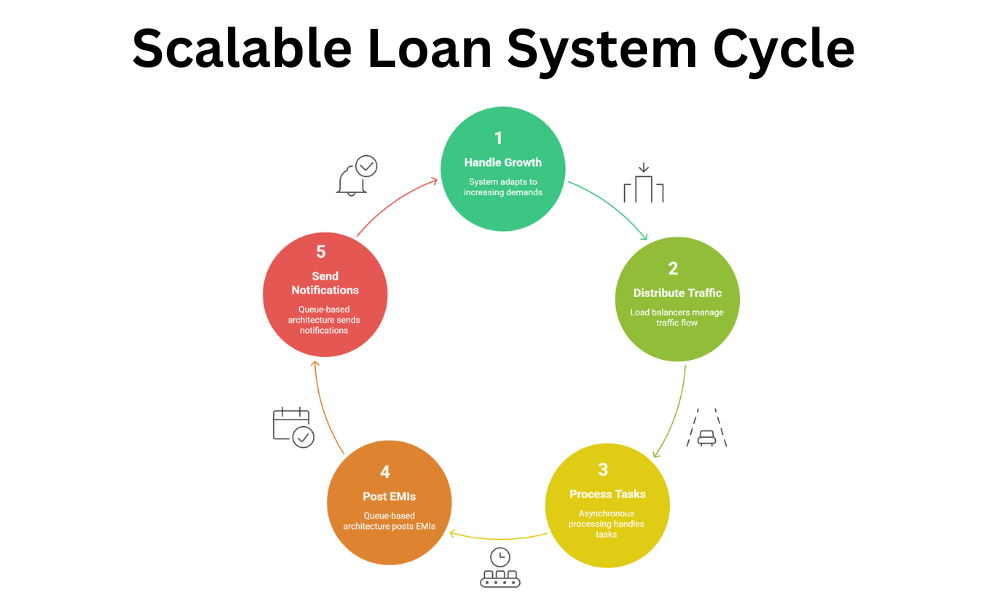

Load Balancing & Asynchronous Processing

Advanced fintech platforms use:

- Load balancers to distribute traffic

- Asynchronous processing for non-critical tasks

- Queue-based architectures for EMI posting and notifications

This ensures system stability even during peak repayment cycles. According to Gartner, cloud-based financial systems improve scalability and resilience by over 40% compared to legacy on-premises systems.

API & Database Design

API-First Architecture

An API-driven design allows loan management software to seamlessly integrate with:

- Payment gateways

- Credit bureaus

- KYC and AML services

- Accounting and ERP systems

This modular approach ensures that NBFCs can add new services without disrupting core operations—crucial for long-term NBFC scalability.

Optimized Database Structures

High-volume lending demands:

- Real-time ledger updates

- Secure transaction logs

- Fast data retrieval

Modern systems use:

- Distributed databases

- Data partitioning

- Read/write optimization techniques

This ensures that even millions of records can be processed efficiently without latency. According to McKinsey, financial institutions using modern data architectures achieve faster decision-making and lower operational costs

Business Benefits of Scalable Loan Management Software

Investing in scalable loan management software delivers measurable business advantages beyond technical performance.

1. Faster Growth Without Operational Chaos

Automation and optimized infrastructure allow NBFCs to:

- Onboard more borrowers

- Launch new loan products faster

- Expand geographically without system changes

Growth becomes structured rather than chaotic.

2. Reduced Cost per Loan

As volumes increase, operational costs do not scale linearly. This improves profitability by:

- Reducing manual intervention

- Lowering error rates

- Minimizing support overhead

3. Improved Customer Experience

Borrowers benefit from:

- Faster approvals

- Accurate EMI schedules

- Real-time account visibility

- Seamless digital interactions

A positive borrower experience directly impacts retention and repayment behavior.

4. Compliance & Risk Control

Built-in audit trails, reporting modules, and data security frameworks help NBFCs stay compliant while managing large portfolios. This reduces regulatory risk and builds institutional credibility. According to PwC, digital lending platforms with integrated compliance controls significantly reduce regulatory exposure for growing NBFCs.

Conclusion: Scaling Lending the Smart Way

High-volume lending is not just about issuing more loans—it’s about managing complexity with confidence. Scalable loan management software empowers NBFCs and fintech lenders to grow sustainably by combining automation, performance-driven architecture, and robust fintech infrastructure.

As lending demand continues to rise, institutions that invest early in scalable systems will be better positioned to handle growth, ensure compliance, and deliver superior customer experiences.

Call-to-Action

If your NBFC or lending business is preparing for rapid growth, now is the time to evaluate your technology foundation. Choose a loan management platform designed for scale, speed, and stability—because the future of lending belongs to systems that can grow as fast as your ambition.