Explore the detailed comparison between in-house loan management systems and SaaS loan software. Learn which option suits your NBFC, MFI, or lending business best in terms of cost, scalability, compliance, and innovation.

Choosing the right loan management solution can make or break your lending business. Whether you’re an NBFC, microfinance institution, or digital lender, the system you use to manage loans determines efficiency, compliance, and customer satisfaction. Businesses traditionally faced two main choices: build an in-house loan management system or adopt a SaaS-based loan software solution.

In this article, we’ll dive deep into the In-House vs SaaS loan software debate — understanding what each option offers, their pros and cons, and which is better suited for modern lenders looking to scale efficiently.

What is an In-House Loan Management Solution?

An in-house loan management solution is a custom-built platform developed and maintained by your internal IT team. It’s designed specifically for your organization’s workflow and requirements.

Advantages of In-House Loan Software

- Full customization: You have complete control over every module — from loan origination to EMI scheduling and credit scoring.

- Data privacy and control: Since everything is stored on your own servers, sensitive financial data remains entirely within your infrastructure.

- Integration flexibility: The system can be easily aligned with your internal accounting, CRM, and payment modules.

Disadvantages of In-House Loan Software

- High development cost: Building from scratch demands huge investment in hardware, software, talent, and ongoing maintenance.

- Longer time to deploy: It can take months, sometimes years, before the final system is ready for use.

- Limited scalability: As your business grows or RBI regulations change, additional development is needed, leading to extra costs.

- Resource dependency: You’re reliant on your internal IT team’s expertise to fix bugs, upgrade systems, or add features.

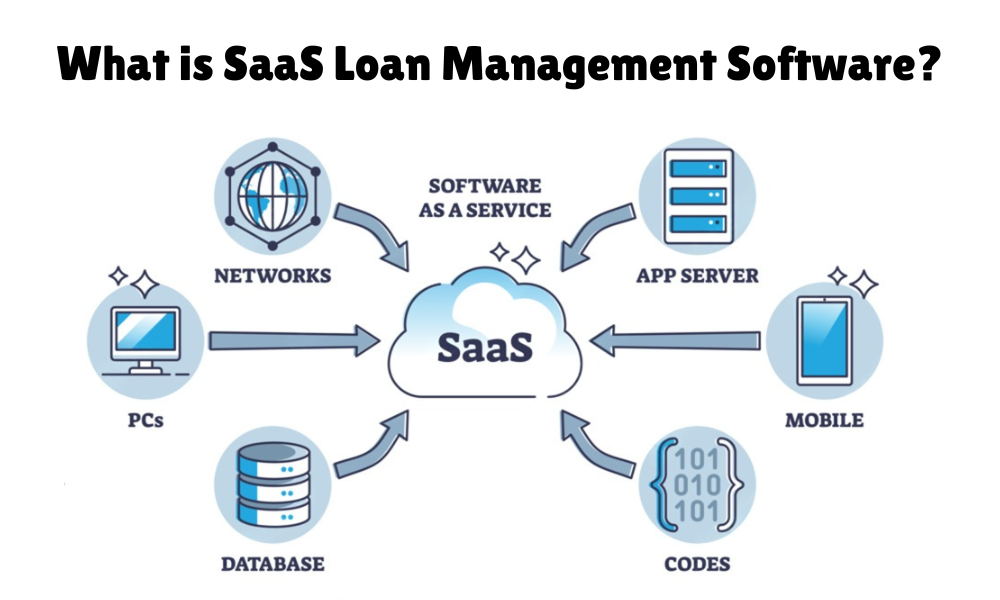

What is SaaS Loan Management Software?

SaaS (Software as a Service) loan software is a ready-to-use, cloud-hosted platform that lenders can access over the internet. Vendors handle updates, maintenance, and security so you can focus on lending operations rather than software infrastructure.

Advantages of SaaS Loan Software

- Faster implementation: Go live within days or weeks instead of months.

- Low upfront cost: Pay only for what you use via monthly or annual plans — no major IT expenses.

- Automatic updates: The provider continuously upgrades the system with new features and compliance capabilities.

- Scalability: Easily scale users, portfolios, and integrations as your business grows.

- Accessibility: Log in from anywhere, on any device — perfect for remote teams or branch-based operations.

Disadvantages of SaaS Loan Software

- Limited customization: While flexible, full custom development might not match the adaptability of an in-house system.

- Data dependency on vendor: Since your data is hosted on cloud servers, you rely on your provider’s security and compliance.

- Ongoing subscription costs: While operational costs are low, recurring fees over time can add up.

Key Comparison: In-House vs SaaS Loan Software

| Feature | In-House Loan Management | SaaS Loan Software |

| Deployment Time | Months to years | Days to weeks |

| Initial Cost | High (development & infrastructure) | Low (subscription-based) |

| Maintenance | Managed internally | Managed by provider |

| Customization | Fully customizable | Configurable but limited |

| Scalability | Slower, manual scaling | Fast, cloud-based scaling |

| Compliance Updates | Requires internal effort | Automatically handled |

| Security Management | Handled internally | Managed by SaaS provider |

| Integration Options | Highly flexible | Available via APIs |

When you look at the In-House vs SaaS loan software comparison side by side, SaaS models often stand out for startups and fast-growing lenders who value agility, affordability, and modernization. In contrast, large established institutions with very specific workflows may opt for an in-house build.

Which Model Suits Your Business Best?

The decision between in-house and SaaS depends on your organization size, operational needs, and long-term goals.

Choose In-House Loan Software If:

- You have a large IT team and budget.

- Security and full system control are your top priorities.

- Your lending workflows are unique or highly specialized.

Choose SaaS Loan Software If:

- You want to go live quickly.

- You prefer a predictable, low-cost model.

- You need scalability, flexibility, and continuous updates.

- You run remote operations or multiple branches.

Regulatory and Compliance Factor

In the financial sector, regulatory compliance is non-negotiable. RBI-mandated reporting, KYC/AML checks, and data security norms need constant updates. SaaS loan platforms often come with pre-built compliance support, ensuring automated updates whenever guidelines change.

On the other hand, in-house software requires your IT team to manually implement every compliance update — an ongoing burden that can lead to delays or penalties if neglected.

The Future of Loan Management: Cloud-Driven and Automated

The fintech industry is rapidly evolving. Meaningful trends — like AI-powered credit scoring, digital onboarding, and real-time payment tracking — are easier to integrate with cloud-based SaaS lending platforms. These systems are built to evolve, offering integration with APIs, payment gateways, and mobile apps seamlessly.

In contrast, in-house solutions often fall behind because of slower upgrade cycles and limited feature flexibility. The modern lending environment demands automation, real-time decision-making, and scalability, which lean heavily in favor of SaaS platforms.

Conclusion: The Smarter Choice for Modern Lenders

Between in-house vs SaaS loan software, the answer lies in your business’s focus. While in-house development offers control and customization, it demands substantial investment and technical capacity. Meanwhile, SaaS loan management systems deliver agility, cost-efficiency, and innovation — making them a practical option for most NBFCs, MFIs, and digital lenders today.

If you’re looking to simplify loan management, reduce operational costs, and scale with modern digital tools, a SaaS-based loan management solution like Grin Technologies’ platform can be your growth partner.

Ready to transform your lending operations?

👉 Book a free demo today and see how SaaS loan software can streamline your loan lifecycle from origination to collection.