Discover how integrating Credit Bureau APIs can revolutionize lending operations, improve credit decision-making, reduce risk, and boost automation efficiency for modern lenders and NBFCs.

As the lending industry continues to embrace digital transformation, Integrating Credit Bureau APIs: Why It’s a Game Changer for Lenders isn’t just a catchy title—it’s the reality of modern finance. Traditional credit evaluation methods are no longer sufficient in a data-driven world where quick, accurate, and automated decisions define business success. By adopting Credit Bureau API integration, lenders can now access real-time borrower data, streamline approval workflows, and minimize the risks associated with manual credit checks.

As competition in the NBFC, fintech, and banking space intensifies, automation has moved from being an option to a necessity. Integrating reliable credit bureau APIs powered by CIBIL, Experian, Equifax, or CRIF High Mark allows lenders to make smarter lending decisions within seconds—transforming both customer experience and operational efficiency.

What is a Credit Bureau API?

A Credit Bureau API acts as a digital bridge that connects a lender’s loan management system with external credit bureau databases. It enables instant fetch of credit reports, scores, and repayment histories of borrowers in real-time.

Instead of manually downloading a credit report, inputting borrower details, and cross-verifying identity—an API integration automates the process end-to-end. Within milliseconds, lenders receive accurate borrower insights such as:

- Credit scores and exposure details

- Active and closed loan accounts

- Credit utilization ratios

- Default and delinquency records

These insights empower lenders to make data-backed credit decisions right from the loan application stage.

Why Integrating Credit Bureau APIs Is a Game Changer for Lenders

1. Real-Time Credit Assessment

In lending, time equals money. Manual credit evaluation can take hours—or even days. Integrating Credit Bureau APIs allows instant access to a borrower’s complete financial behavior profile in real-time. This leads to:

- Faster loan disbursements

- Reduced turnaround time for approvals

- Enhanced borrower experience

Instant credit check automation ensures lenders remain competitive while reducing risk exposure.

2. Greater Accuracy and Reduced Fraud

Since the data comes directly from credit bureaus, API-based integration eliminates human errors and data manipulation risks. Lenders can trust that every credit score, repayment record, and inquiry detail is legitimate and up-to-date.

Moreover, integration with multiple bureau APIs (e.g., Experian and CRIF) provides cross-verification, helping block high-risk applicants and reduce the chances of loan defaults.

The Operational Benefits of Credit Bureau API Integration

1. Seamless Automation Across Systems

When connected to a loan management system (LMS) or CRM, Credit Bureau APIs ensure that every loan application automatically triggers a credit check. No manual entry, no waiting—just streamlined digital processing.

This automation reduces manual workload, lowers operational costs, and ensures compliance with internal credit policies.

2. Enhanced Risk Analytics

Credit Bureau APIs don’t just fetch scores—they offer deep analytics that help lenders predict borrower behavior. By analyzing repayment trends, debt-to-income ratios, and credit exposure, lenders can create risk profiles and determine credit limits automatically.

Many advanced lenders even integrate this data with AI and ML-driven decision engines to predict default probabilities and optimize lending portfolios.

3. Better Compliance and Audit Trails

Regulatory compliance is crucial for lenders operating in India’s highly regulated financial ecosystem. APIs maintain secure, encrypted communication channels that ensure compliance with RBI and data protection norms.

Every credit check action leaves a digital footprint—providing complete transparency and audit readiness.

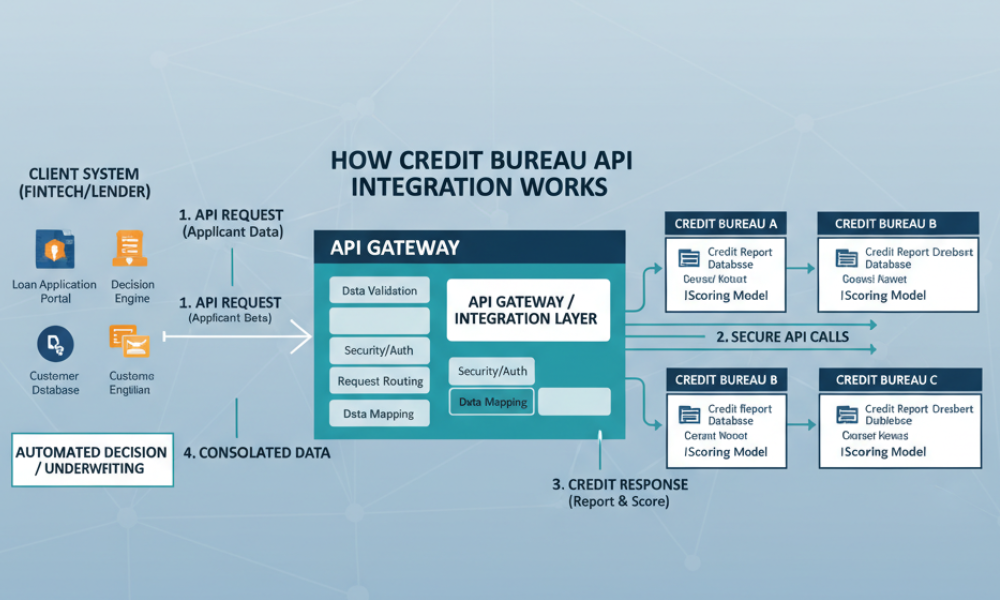

How Credit Bureau API Integration Works

Step 1: Borrower Consent and Data Input

When a borrower applies for a loan online, they authorize the lender to access their credit report. The API then captures essential details like PAN, mobile number, or Aadhaar.

Step 2: API Request to Bureau

The lender’s system sends a secure encrypted request to the credit bureau through the API.

Step 3: Real-Time Response

Within seconds, the bureau shares the borrower’s comprehensive credit data. This includes their credit score, active accounts, loan repayments, and defaults.

Step 4: Automated Decision

The lender’s system processes this data based on internal credit policies or score cut-offs to make instant decisions—approve, reject, or flag for manual review.

Key Advantages for NBFCs and Digital Lenders

- Faster customer onboarding: Instant lending approval builds trust and increases conversion rates.

- Cost efficiency: Fewer manual verifications and reduced manpower costs.

- Improved portfolio quality: Real-time data ensures only eligible borrowers are approved.

- Customizable API solutions: Integrate with multiple bureaus for optimized decision-making.

- Scalable framework: Ready for expansion across multiple loan products like personal loans, credit lines, and buy-now-pay-later schemes.

Integrating Credit Bureau APIs with Loan Management Software

When credit bureau APIs work hand-in-hand with a loan management system (LMS), lenders achieve complete process automation—from borrower onboarding to repayment tracking.

A typical integration enables:

- Automated credit checks during loan application

- Instant credit score display for underwriters

- Rule-based decisioning and risk categorization

- Faster movement from approval to disbursal

By aligning LMS and API integration, NBFCs and fintech startups create a synergy that significantly enhances their lending speed, accuracy, and compliance.

Security, Compliance, and Data Privacy

Data security sits at the heart of every financial transaction. Integrating Credit Bureau APIs via secure encryption standards like HTTPS, OAuth, and token-based authentication ensures borrower data remains safe from breaches.

Additionally, following RBI’s Fair Practices Code and Data Privacy Guidelines helps institutions maintain full compliance while leveraging automation.

The Future of Lending with Credit Bureau APIs

With the rise of embedded finance and digital lending platforms, the adoption of credit bureau APIs will keep growing. Soon, lenders will integrate additional data sources such as alternative credit scoring models, social footprint analysis, and bank statement aggregation.

These technologies together will form the foundation of next-generation lending ecosystems, where customer experience, decision accuracy, and compliance are seamlessly interconnected.

Conclusion: The Smart Move for Every Lender

In an increasingly digital financial landscape, Integrating Credit Bureau APIs: Why It’s a Game Changer for Lenders lies in its power to simplify, secure, and speed up lending operations. It eliminates manual inefficiencies, enhances decision accuracy, and helps lenders offer quick, transparent, and data-driven credit solutions.

If your institution aims to scale efficiently while reducing bad loans, it’s time to integrate Credit Bureau APIs into your loan management process.