Discover how the role of machine learning in predicting loan defaults is revolutionizing credit risk assessment. Learn key algorithms, real-world benefits, and strategies for lenders to reduce losses and improve lending decisions.

Hey there, if you’re in lending, fintech, or managing loans like at an NBFC or MFI, you know the drill: one bad default can wipe out a month’s profits. That’s where the role of machine learning in predicting loan defaults comes in. It’s not some futuristic gimmick – it’s already helping companies spot trouble early by crunching massive data sets that old-school credit scores miss. Think transaction patterns, job changes, even spending quirks from UPI flows. Banks and fintech’s are slashing losses by 20-30% with this stuff. Stick around – I’ll break it down simply; with tips you can actually use.

Why Loan Default Prediction Matters More Than Ever

Loan defaults—when borrowers fail to repay—cost the global financial industry billions annually. In India alone, NBFC and microfinance sectors saw NPAs spike during economic downturns, underscoring the need for smarter risk management. Enter machine learning: a subset of AI that learns from data to make predictions without being explicitly programmed.

The Limitations of Traditional Credit Scoring

Old-school models rely on static factors like FICO scores, income verification, and collateral value. They’re rigid and overlook dynamic signals, such as spending habits or employment volatility. For instance, a high-income earner with erratic cash flows might slip through, while a gig worker with steady UPI transactions gets unfairly rejected.

Machine learning flips this by processing alternative data: mobile app usage, utility payments, even smartphone sensor data (ethically sourced). This holistic view boosts prediction accuracy from 70-80% in legacy systems to over 90% in ML-driven ones.

How Machine Learning Powers Default Prediction

At its core, ML uses algorithms to identify patterns in historical loan data, labeling “defaulters” vs. “non-defaulters.” Lenders train models on features like debt-to-income ratio, payment history, and macroeconomic indicators.

Key Machine Learning Algorithms for Credit Risk

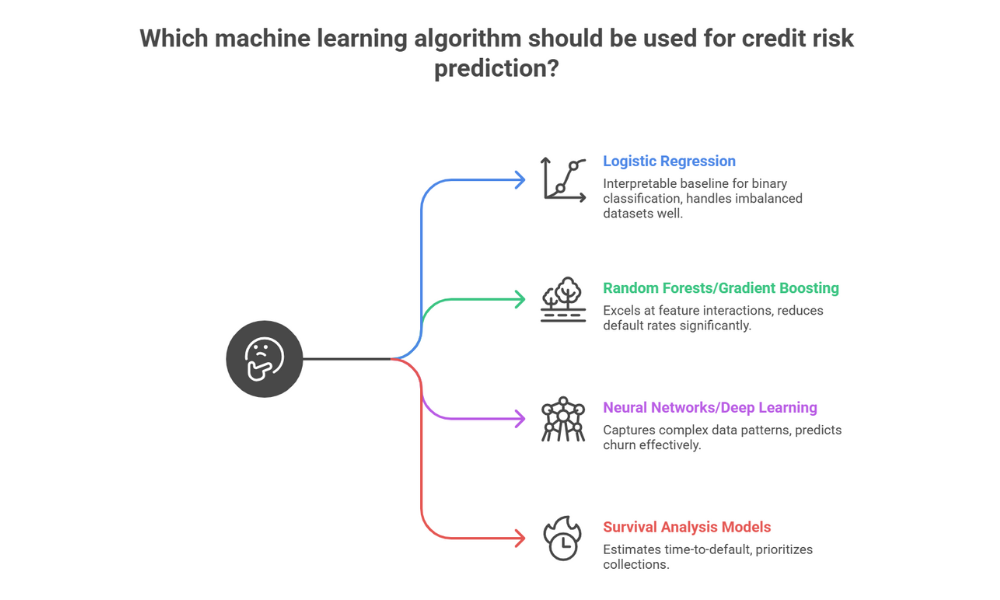

Here’s where the magic happens. Different algorithms shine for various scenarios:

- Logistic Regression: A baseline for binary classification (default/no default). It’s interpretable and handles imbalanced datasets well crucial since defaults are rare (5-10% of portfolios).

- Random Forests and Gradient Boosting Machines (e.g., XGBoost, LightGBM): These ensemble methods excel at feature interactions. XGBoost, for example, reduced default rates by 25% at LendingClub by weighing variables like loan purpose and borrower age dynamically.

- Neural Networks and Deep Learning: For complex data like text from loan applications or time-series transaction logs. LSTM networks capture sequential patterns, predicting churn before it hits.

- Survival Analysis Models: Like Cox Proportional Hazards, they estimate time-to-default, helping prioritize collections.

Data Sources Fueling ML Models

Modern ML thrives on diverse inputs:

- Structured Data: Credit scores, EMI history, income docs.

- Unstructured Data: NLP on social profiles or call transcripts for sentiment analysis.

- Real-Time Data: UPI/eNACH flows, geolocation for fraud detection.

- External Signals: Economic indices, weather impacts on agri-loans.

In India, Account Aggregator frameworks and Open Credit Enablement Network (OCEN) unlock consented data sharing, supercharging ML accuracy for fintechs.

Real-World Benefits and Case Studies

The proof is in the pudding. ML isn’t theoretical—it’s delivering tangible ROI.

Quantifiable Gains for Lenders

- Lower Loss Rates: JPMorgan’s ML models cut delinquencies by 20%.

- Faster Approvals: Automated scoring approves 40% more loans without added risk.

- Cost Savings: Predictive analytics optimizes collections, recovering 15-20% more via targeted outreach.

- Inclusion Boost: ML assesses thin-file borrowers (e.g., MSMEs), expanding access in underserved markets.

A Grin Technologies-like fintech could use ML in loan management software to flag high-risk group loans early, aligning with RBI’s digital lending guidelines.

Indian Fintech Success Stories

- Paytm and PhonePe: Integrate ML for BNPL default prediction, using UPI patterns.

- Bajaj Finserv: XGBoost models on 50M+ data points predict personal loan defaults.

- Pine Labs/ZestMoney: BNPL platforms leverage real-time ML to approve micro-loans instantly.

These cases show ML’s role in scaling responsibly amid India’s 600M+ digital users.

Challenges and Best Practices for Implementation

No silver bullet—ML has hurdles.

Common Pitfalls to Avoid

- Data Bias: Models trained on historical data perpetuate inequalities (e.g., gender/region bias). Solution: FairML techniques like adversarial debiasing.

- Black-Box Opacity: Regulators demand explainability. Use SHAP/LIME for model interpretability.

- Overfitting: Too much data noise leads to false positives. Cross-validation and regularization fix this.

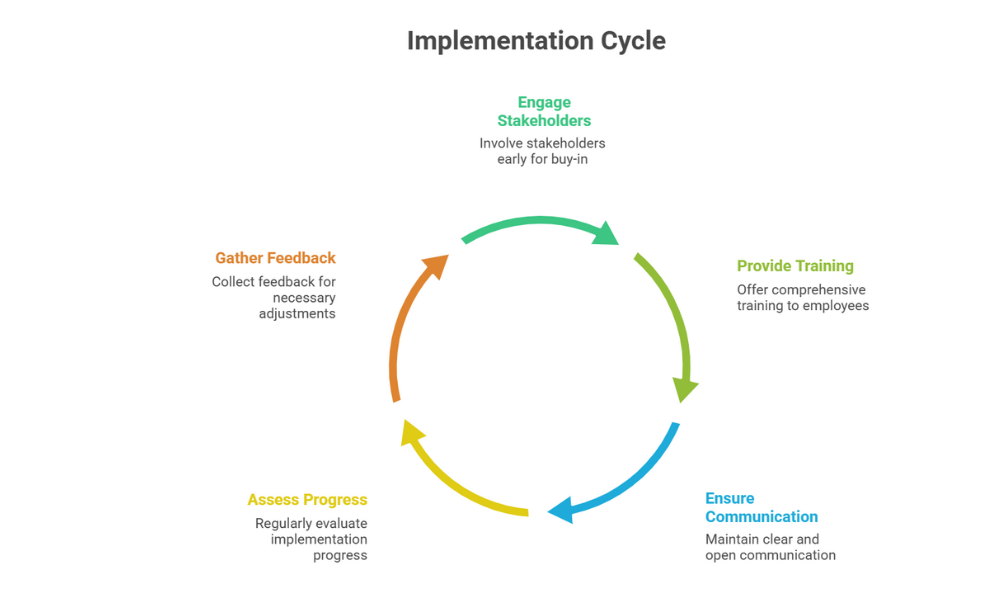

Step-by-Step Implementation Guide

- Data Collection: Aggregate from CRM, CIBIL, and APIs.

- Preprocessing: Clean outliers, engineer features (e.g., DTI trends).

- Model Training: Split 70/20 train-test; use AUC-ROC for evaluation (>0.85 ideal).

- Deployment: MLOps tools like Kubeflow for real-time scoring.

- Monitoring: Retrain quarterly on fresh data.

For product managers at fintechs like Grin, start with pilot cohorts to validate uplift.

The Future: ML and Emerging Trends in Credit Risk

Looking ahead, machine learning in loan default prediction evolves with:

- Federated Learning: Privacy-preserving models across institutions.

- Generative AI: Synthetic data for rare default scenarios.

- Blockchain Integration: Immutable audit trails for ML decisions.

In India, RBI’s push for AI ethics and Digital India will accelerate adoption, potentially slashing NPAs to single digits.

Conclusion: Embrace ML for Smarter Lending

The role of machine learning in predicting loan defaults isn’t just transformative—it’s essential for survival in competitive fintech. By harnessing algorithms, diverse data, and ethical practices, lenders minimize risks, serve more customers, and drive growth. Whether you’re at an NBFC, MFI, or building loan management software, integrating ML today positions you ahead.

Ready to level up your credit risk game? Audit your portfolio, experiment with XGBoost, or partner with ML-savvy platforms. Share your thoughts below—what’s your biggest challenge in default prediction? Let’s connect!