Stop chasing late payments. Discover 10 actionable tips to configure your loan recovery software for faster collections, automated follow-ups, and lower NPAs. A practical guide for lenders.

The Ultimate Guide to Loan Recovery Software: 10 Tips to Boost Collections Fast

In the lending business, the gap between a “payment due” and a “payment received” can define your profitability. Manual follow-ups, messy spreadsheets, and inconsistent communication create leaks in your collection funnel, leading to rising non-performing assets (NPAs). This is where loan recovery software becomes a game-changer. It’s not just a tool; it’s a strategy. By automating the right steps, you can turn a reactive, stressful process into a proactive, data-driven system that boosts collections while preserving customer relationships.

This guide provides ten practical, actionable tips to unlock the full potential of your loan recovery software, helping you reduce delinquencies and speed up repayments starting today.

Why Your Manual Collections Process Is Costing You Money

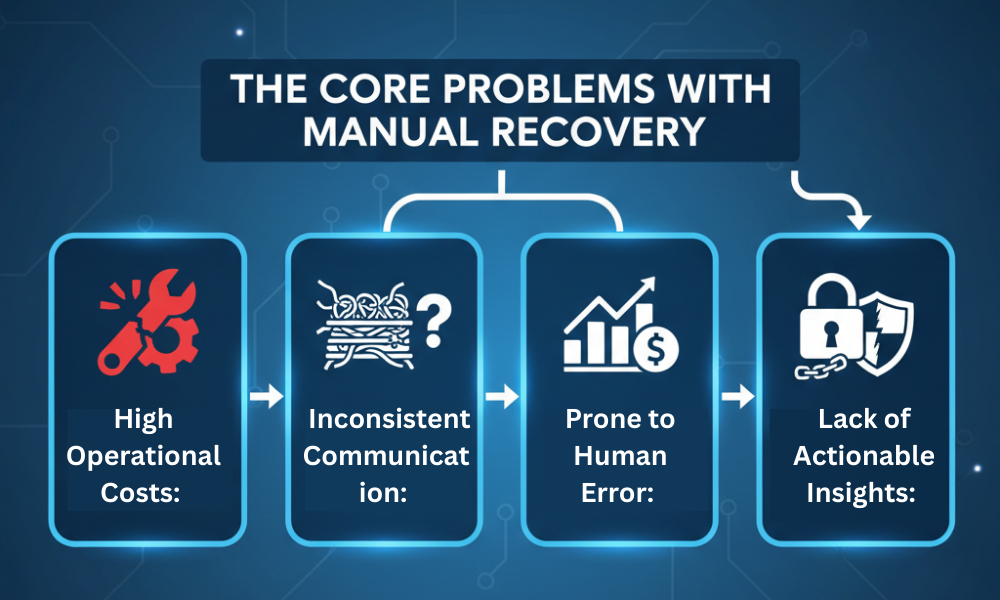

Before diving into solutions, it’s crucial to understand the hidden costs of outdated recovery methods. Relying on phone calls and Excel sheets is not only inefficient but also creates significant business risks.

The Core Problems with Manual Recovery:

- High Operational Costs: Manual processes require a large team to manage calls, send reminders, and update records, leading to high overhead.

- Inconsistent Communication: Without a centralized system, different agents might contact the same borrower with conflicting information, causing confusion and frustration.

- Prone to Human Error: Manual data entry can lead to incorrect payment records, missed follow-ups, and compliance breaches.

- Lack of Actionable Insights: Spreadsheets can’t provide the real-time analytics needed to identify trends, predict delinquencies, or measure agent performance effectively.

10 Actionable Tips to Master Your Loan Recovery Software

Implementing loan recovery software is the first step. Optimizing it is what delivers transformative results. Here are ten tips to configure your system for maximum impact.

1. Segment Borrowers for a Tailored Approach

Not all overdue accounts are the same. A borrower who missed a payment for the first time requires a different approach than a chronic defaulter. Use your software to segment your borrowers based on:

- DPD (Days Past Due): Create buckets like 1-30, 31-60, and 61-90+ days.

- Risk Profile: Use historical data to assign a risk score to each borrower.

- Payment History: Differentiate between first-time and repeat delinquents.

This segmentation allows you to automate targeted communication strategies that are more effective and respectful.

2. Automate a Multi-Channel Reminder Campaign

Relying on a single channel is a recipe for being ignored. An effective dunning strategy uses a mix of channels. Configure your software to send automated, personalized reminders via:

- SMS: For quick, high-visibility alerts.

- WhatsApp: For more interactive communication and sending payment links.

- Email: For formal communication and sending detailed statements

- Automated Voice Calls (IVR): For pre-recorded reminders to landlines and mobile numbers.

3. Make It Ridiculously Easy to Pay

The single biggest barrier to collection is often a complicated payment process. Integrate your loan recovery software with multiple payment gateways to offer one-click payment options, including:

- UPI (Unified Payments Interface)

- Credit and Debit Cards

- Net Banking

- Digital Wallets

Embed payment links directly in your SMS and WhatsApp reminders to reduce friction and improve conversion rates.

4. Leverage the Power of a Centralized Dashboard

Your software’s dashboard is your command center. It should give you a 360-degree view of your entire collections operation at a glance. Focus on tracking these key performance indicators (KPIs):

- Total Amount Overdue

- Collection Rate

- Promise-to-Pay (PTP) Conversion Rate

- Agent Productivity

Use these insights to make data-driven decisions and adjust your strategy in real time.

5. Use Predictive Analytics to Prevent Delinquency

The best way to manage a late payment is to prevent it from happening in the first place. Modern loan recovery software uses AI and machine learning to analyze borrower behavior and identify who is at high risk of defaulting. This allows you to intervene early with proactive solutions like a temporary payment extension or a restructured payment plan.

6. Digitize and Centralize All Loan Documentation

Move away from physical paperwork. Use your software to digitize and store all loan agreements, KYC documents, and communication history in a secure, centralized repository. This ensures that your agents have instant access to all the information they need, right when they need it, ensuring compliance and efficiency.

7. Prioritize a Mobile-First Communication Strategy

Your borrowers live on their phones. Your collection strategy should too. Ensure that all your communications, from reminders to payment portals, are optimized for mobile devices. SMS and WhatsApp messages have significantly higher open rates than emails, making them your most powerful tools for engagement.

8. Empower Your Team with Empathy and Training

While automation handles the repetitive tasks, your human agents are crucial for handling complex cases. Train your team to be empathetic problem-solvers, not just collectors. A respectful conversation that aims to find a mutually agreeable solution is far more effective than an aggressive demand for payment. This approach not only improves recovery rates but also protects your brand reputation.

9. Set Up a “Broken Promise” Workflow

A borrower who makes a promise to pay and then fails to do so is a critical lead. Create an automated workflow that immediately triggers a follow-up communication the moment a promised payment is missed. This shows the borrower you are paying attention and significantly increases the chances of a quick recovery.

10. Continuously Test and Optimize Your Strategy

Your loan recovery strategy should never be static. Use your software’s analytics to constantly test and refine your approach. A/B test different message templates, communication channels, and follow-up timings to see what works best for different borrower segments. A culture of continuous optimization is the key to long-term success.

Conclusion: Transform Your Collections from a Cost Center to a Profit Center

By moving away from outdated manual processes and embracing the power of loan recovery software, you can do more than just collect payments. You can build a more efficient, scalable, and customer-centric operation. These ten tips provide a practical roadmap to reducing your NPAs, speeding up repayments, and ultimately, boosting your bottom line.

Ready to take control of your loan recovery process? Schedule a personalized demo today to see how our software can help you implement these strategies and revolutionize your collections.

3 replies on “Top 10 Loan Recovery Software Tips to Cut NPAs & Boost Collections”

[…] Loan recovery automation […]

[…] (LMS) is a tool designed to automate the complete loan lifecycle—from application and approval to EMI tracking and collection. It helps lenders manage accounts, payments, and compliance all within a single platform, replacing […]

[…] EMI schedules, reminders, and collections are automated […]