Learn the top 5 mistakes lenders make when choosing loan management software. Avoid common errors NBFCs, microfinance companies, and lending institutions face when selecting the best loan management system in India.

The right loan management software isn’t just another application—it’s the operational backbone that drives speed, compliance, collections, underwriting accuracy, and borrower experience across the lending lifecycle. Pick well and workflows click into place; pick wrong and teams drown in manual work, rework, and hidden costs that erode margins and trust. This guide breaks down the biggest decision traps lenders fall into when choosing loan management software—and shows how to dodge them with simple, practical checks and a battle‑tested evaluation checklist.

In the competitive financial sector, selecting the right loan management software is one of the most critical decisions for NBFCs, microfinance companies, and lending startups. A good loan management system helps automate collections, streamline loan servicing, ensure compliance, and improve borrower satisfaction. However, choosing the wrong platform can drain resources, limit scalability, and damage customer trust.

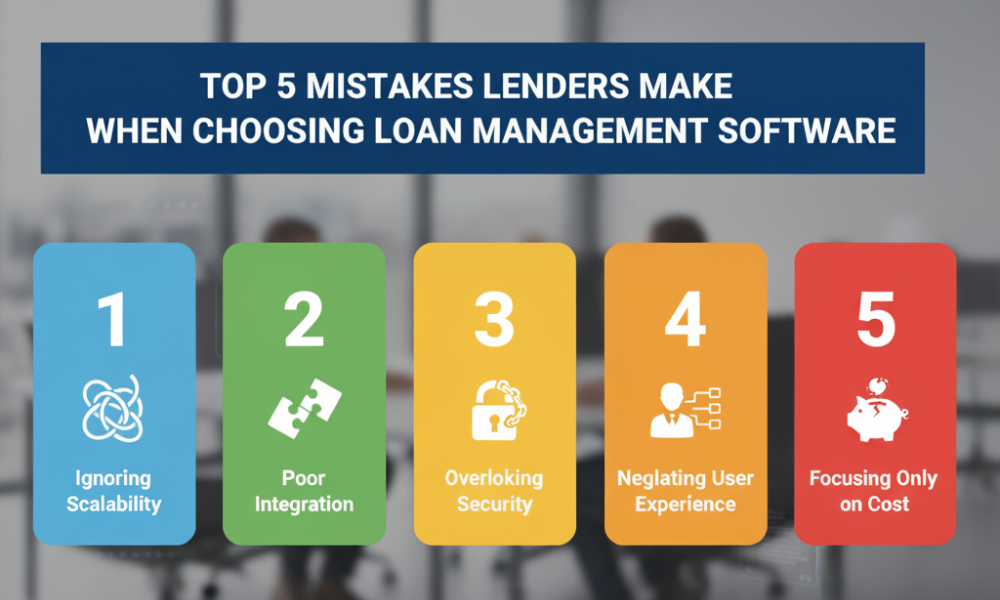

Unfortunately, many lenders fall into the same traps when deciding on a digital loan management solution. Let’s uncover the top 5 mistakes lenders make when choosing loan management software—and how you can make a smarter, future-ready choice.

Top 5 Loan Software Selection Mistakes

Mistake 1: Focusing Only on Price Instead of Value

Some lenders try to cut costs by selecting the cheapest lending software available. While saving money upfront feels attractive, low-cost systems often lack critical features such as:

- Loan recovery automation

- Digital EMI collections with payment gateways

- Real-time borrower credit scoring

- Cloud-based loan servicing

This leads to higher long-term costs, manual inefficiencies, and poor borrower experience. Instead of focusing only on price, evaluate the value of the loan automation software—does it reduce turnaround time, improve repayment rates, and support compliance? Choosing the best loan management software in India ensures you gain maximum ROI in the long run.

Mistake 2: Ignoring Scalability and Flexibility

A big oversight is selecting software only for present needs, not future growth. Many NBFCs and microfinance lenders soon realize their software struggles to handle increased borrowers, new loan products (gold loans, SME loans, group loans), or multiple branches.

Scalability ensures that your cloud-based loan management system can grow with your business. Whether you expand nationally, add thousands of borrowers, or diversify lending models, your loan servicing software should support that transition seamlessly.

Mistake 3: Overlooking Regulatory Compliance and Data Security

Compliance and security are non-negotiable in lending. However, many institutions choose outdated systems that don’t meet RBI requirements, posing risks of penalties and customer mistrust.

An ideal loan management platform should offer:

- Automated RBI-compliant reporting

- Encrypted borrower data storage

- Role-based access controls

- Secure digital audit trails

By focusing on loan compliance software, you protect sensitive borrower information while staying aligned with strict financial regulations.

Mistake 4: Poor System Integration Capabilities

Today’s fintech ecosystem thrives on connectivity. Most lenders use multiple tools—CRM, payment gateways, accounting software, mobile apps, and credit bureau APIs. Unfortunately, many loan collection software vendors do not offer smooth integration, creating data silos and manual errors.

Always ask:

- Can this loan servicing software integrate with third-party payment apps for EMI collection?

- Does it sync with accounting tools for financial reconciliation?

- Is it compatible with credit bureau APIs?

Strong integration ensures your digital loan servicing system works as a unified platform, boosting efficiency and borrower satisfaction.

Mistake 5: Neglecting User Experience (Staff & Borrowers)

Software usability is often underrated. Complicated dashboards frustrate staff, while clunky borrower portals reduce adoption. Poor user experience leads to inefficiency, training challenges, and low customer engagement.

Modern loan origination and servicing software should have:

- Simple, intuitive dashboards for lenders

- Mobile-friendly borrower self-service portals

- Easy EMI payment and loan tracking access

- Minimal manual intervention

When borrowers and employees find the system easy to use, it reduces friction and enhances productivity. A user-friendly borrower management system builds trust and loyalty.

How to Choose the Best Loan Management Software in India

Avoiding these mistakes is the first step in selecting reliable loan servicing software. To make an informed choice, keep these in mind:

- Pick software that delivers value over cost

- Ensure scalability for NBFC and microfinance growth

- Demand industry-standard data security and compliance features

- Look for integrations with CRMs, credit bureaus, and payment systems

- Prioritize platforms with strong UI/UX design

Conclusion: Build a Future-Ready Lending Business

Your loan management software is not just another tool—it is the backbone of your lending operations. By avoiding these 5 mistakes, you can choose the best platform to streamline loan origination, automate recovery, ensure compliance, and grow faster in today’s competitive market.

If you are a lender, NBFC, or microfinance institution looking for a cloud-based loan management system tailored for India’s lending market, we can help.

Get in touch today for a free demo and discover how our advanced loan management solutions can simplify your lending business, boost collections, and accelerate growth.