Discover the top features every loan management software should have to streamline loan processing, improve customer service, and ensure compliance. Learn about automation, real-time reporting, and integrations that make loan management efficient and secure.

Introduction: Is Your Loan Management Process Holding You Back?

What if you could cut your loan processing time by half while reducing errors to near zero? Imagine waking up to find that payment reminders went out automatically, compliance reports generated themselves, and your team focused only on high-value tasks instead of drowning in paperwork. Sounds like a dream, right?

For many lenders, NBFCs, and fintech companies, this isn’t fantasy—it’s the reality that modern loan management software delivers. Yet, countless financial institutions still struggle with fragmented systems, manual data entry, and compliance headaches that drain resources and frustrate customers. The question isn’t whether you need better loan management tools, but rather: which features will actually transform your lending operations from chaotic to seamless?

In this comprehensive guide, we’ll explore the top features every loan management software should have to revolutionize your lending business. Whether you’re evaluating your first LMS or looking to upgrade, these insights will help you make a decision that boosts efficiency, ensures compliance, and delights your borrowers at every touchpoint.

What is Loan Management Software?

Loan management software is a comprehensive digital platform designed to manage the entire lifecycle of a loan—from initial application and credit assessment to disbursal, repayment tracking, and final closure. Unlike traditional manual processes that rely on spreadsheets and paper documents, modern LMS platforms automate workflows, reduce human error, and provide real-time visibility into loan portfolios. These systems serve as the central nervous system for lending operations, integrating with credit bureaus, payment gateways, and banking systems to create a seamless experience for both lenders and borrowers. For financial institutions handling diverse loan products, robust loan servicing software becomes indispensable for maintaining accuracy, ensuring regulatory compliance, and delivering superior customer service.

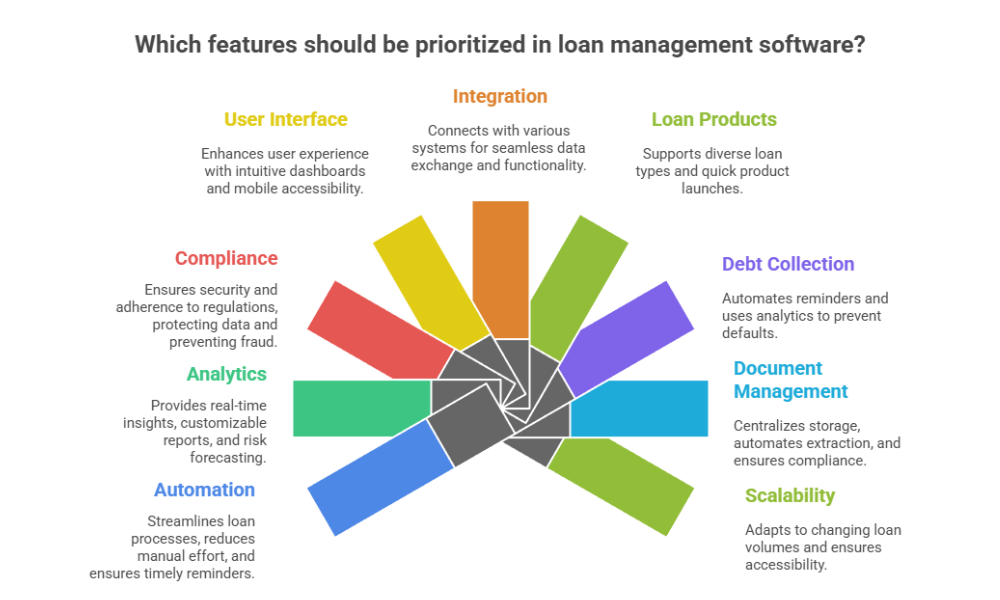

Top Features Every Loan Management Software Should Have

Automation of Loan Lifecycle

- Automates loan origination, document verification, credit scoring, approval workflows, disbursal, repayment scheduling, and closure

- Generates amortization schedules automatically

- Sends timely payment reminders via SMS and email

- Flags compliance issues through automated rule engines

Real-time Analytics and Reporting

- Provides dashboards with key performance indicators like application volume, approval rates, and delinquency percentages

- Enables customizable reporting by product, branch, or loan officer

- Uses predictive analytics to forecast risks and optimize collections

Compliance and Security Features

- Supports anti-fraud mechanisms and data privacy regulations like GDPR

- Includes multi-factor authentication and document validation

- Offers encrypted data storage and automated compliance checks

User-friendly Interface and Accessibility

- Features intuitive dashboards for lenders to track borrower profiles and loan statuses

- Provides mobile-responsive design and borrower self-service portals

- Allows upload of documents, e-signatures, and status updates for borrowers

Integration Capabilities

- Connects with credit bureaus for real-time credit scoring

- Integrates with e-KYC validation, accounting software, and payment gateways

- Supports API-first architecture for easy addition of new tools

Flexible Loan Products Support

- Handles multiple loan types with customizable terms, interest rates, and repayment options

- Enables quick launch of new loan products without software delays

- Supports diverse borrower segments, from salaried employees to small business owners

Proactive Debt Collection Mechanisms

- Sends automated reminders on multiple channels such as SMS, email, and WhatsApp

- Uses borrower traceability and data enrichment for accurate contact info

- Employs predictive analytics to identify early warning signs of default

- Automates workflow escalation while maintaining regulatory compliance

Document Management and Digitization

- Centralizes document storage with secure digital access

- Supports OCR for automatic data extraction and AI for document verification

- Integrates e-signature for faster loan onboarding

- Ensures easy retrieval and audit compliance through organized record-keeping

Scalability and Cloud-Based Architecture

- Scales resources dynamically to handle increased loan volume

- Reduces IT overhead with cloud-hosted infrastructure

- Offers 24/7 accessibility and disaster recovery options

- Maintains updated features and security patches regularly

Additional Benefits of Loan Management Software

Beyond these core features, loan management software improves operational efficiency by enabling lenders to process many more applications with the same team size. Customer experience improves through smooth communication and self-service options, increasing loyalty and referrals. Integrations with credit scoring and alternative data help accurately assess risk and reduce defaults. Detailed reporting simplifies audits and provides transparency for investors, enabling better strategic planning and growth.

Conclusion: Choosing the Right Loan Management Software

The success of any lending institution largely depends on its choice of loan management software. Automation, real-time analytics, compliance support, flexible product handling, and proactive collections are fundamental for modern, competitive lending. As the fintech landscape evolves, cloud-based and scalable platforms with open APIs ensure your business stays agile and compliant. Upgrading from manual or legacy systems isn’t just beneficial—it’s essential to keep pace with competitors and market demands.

Call to Action

Ready to transform your loan management processes and gain a competitive edge? Explore cutting-edge loan management software solutions tailored specifically for NBFCs, fintech companies, and lending institutions. Contact our team today for a personalized demo and discover how the right LMS can drive efficiency, ensure compliance, and accelerate your lending growth.

1 reply on “Top Features Every Loan Management Software Should Have 2025”

[…] may follow slightly different workflows, leading to inefficiencies and risk exposure. Effective multi branch loan management addresses this by standardizing operations while still allowing local […]