Discover why lenders are moving toward no‑code loan platforms to launch products faster, cut IT costs, and scale digital lending with less risk.

If you work in lending today, you already know the pressure: launch new loan products faster, cut operating costs, stay compliant, and still deliver a smooth digital experience to borrowers. No‑code loan platforms are fast becoming the go‑to solution because they let business teams design, launch, and tweak lending workflows without depending heavily on developers. This shift is reshaping how banks, NBFCs, fintechs, and digital lenders think about technology and growth.

Below is a deep dive into why lenders are moving toward no‑code loan platforms, and how this change is impacting product innovation, risk, and customer experience across the lending ecosystem.

What Is a No-Code Loan Platform?

A no‑code loan platform is a digital lending system that allows users to configure loan products, workflows, and rules using visual, drag‑and‑drop interfaces instead of writing traditional code.

- Business teams can set up loan origination, underwriting, approvals, and collections with pre‑built components.

- Lenders can modify credit rules, customer journeys, and integrations through configuration rather than long development cycles.

In simple terms, it turns “tech changes” into “business changes” that can be shipped quickly, without waiting months for IT or external vendors.

Why Lenders Are Moving Toward No-Code Loan Platforms

Lenders are adopting no‑code loan platforms because they solve several long‑standing pain points in traditional lending technology: long IT queues, rigid core systems, and high customization costs.

From faster time‑to‑market to better compliance readiness, these platforms match the realities of a digital‑first lending market where speed and agility are non‑negotiable.

Faster Time-to-Market for New Loan Products

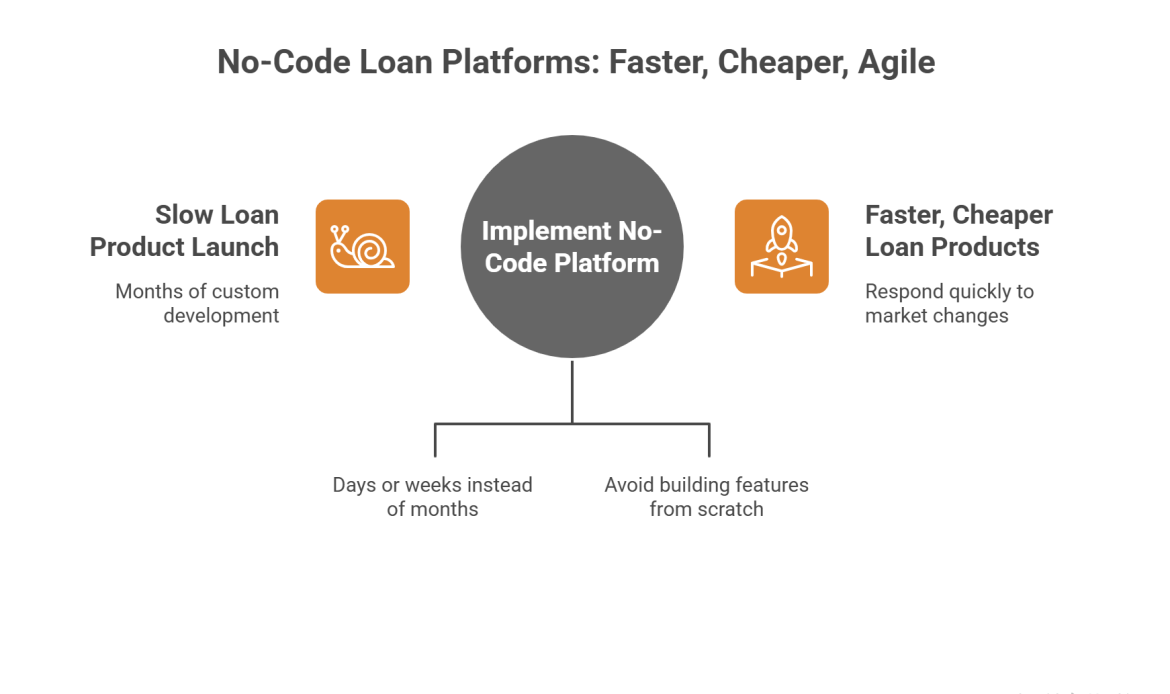

Speed is one of the biggest reasons lenders are moving toward no‑code loan platforms.

- Traditional loan systems often need months of custom development to launch or tweak a product.

- No‑code lending platforms let teams configure new flows, eligibility rules, and document requirements in days or weeks instead of months.

This agility helps lenders respond quickly to new market segments, regulatory changes, or competition—without rewriting large chunks of code every time.

Lower Technology and Operational Costs

Another major driver behind the shift to no‑code loan platforms is cost efficiency.

- No‑code digital lending platforms reduce the need for large in‑house development teams and long implementation projects.

- Because most components (KYC, document upload, e‑mandate, EMI schedules, notifications) are reusable, lenders avoid building the same features from scratch for each new product.

Over time, this leads to lower total cost of ownership compared to fully custom systems while still allowing high levels of flexibility.

Empowering Business Teams and Reducing IT Bottlenecks

In many banks and NBFCs, product and credit teams depend heavily on IT or vendors for even small changes. No‑code loan platforms flip this model.

- Business users can manage workflows (from application to disbursement and collections) using visual builders and rule engines.

- IT teams can focus on governance, security, and integrations instead of day‑to‑day configuration changes.

This reduces internal friction, speeds up decision‑making, and encourages continuous experimentation with new digital lending journeys.

Better Digital Borrower Experience

Modern borrowers expect quick, app‑like experiences with transparent status updates and minimal paperwork. No‑code loan platforms make it easier for lenders to deliver this.

- Lenders can design intuitive, mobile‑friendly application journeys with fewer clicks and better guidance.

- Features like real‑time application tracking, instant eligibility checks, and digital document verification can be plugged in with pre‑built modules.

As a result, lenders see higher completion rates, fewer drop‑offs, and improved customer satisfaction across retail and MSME lending segments.

High Configurability and Product Experimentation

One big reason lenders are moving toward no‑code loan platforms is their ability to quickly test and refine products for micro‑segments.

- Credit teams can configure different rule sets, ticket sizes, interest slabs, and tenures for various customer profiles without new development.

- Lenders can A/B test journeys (for example, fully digital vs assisted journeys) and optimize for conversion and risk.

This level of configurability is especially valuable for fintechs and digital lenders targeting niche segments like gig workers, small merchants, and sector‑specific MSMEs.

Seamless Integration with Existing Systems

Modern lending stacks involve core banking, LOS/LMS, payment gateways, credit bureaus, e‑sign, e‑mandate, and analytics tools. No‑code loan platforms are designed to sit in the middle of this ecosystem.

- They typically offer API‑first architectures, making it easier to plug into existing systems and third‑party services.

- Data flows more smoothly between underwriting, disbursement, and collections, reducing manual effort and reconciliation errors.

For many lenders, this is a practical middle path between rigid legacy systems and expensive, fully custom tech builds.

Built-In Compliance and Risk Controls

Regulation in lending changes frequently, and manual updates across systems are risky and slow. No‑code lending platforms increasingly come with compliance‑ready frameworks.

- Central rule engines and policy layers allow quick updates to KYC, AML, and underwriting rules without rewriting code.

- Audit trails, access controls, and standardized workflows make it easier to demonstrate compliance during audits and inspections.

This reduces operational risk while giving compliance and risk teams more direct control over how policies are implemented in the system.

Scalability and Performance for Growing Portfolios

As lenders onboard more customers, manual processes and semi‑manual systems start breaking down. No‑code loan platforms are built with scalability in mind.

- Cloud‑native no‑code lending systems can handle growing volumes of applications and transactions without needing a full re‑architecture.

- Automation of document verification, scoring, and repayment reminders helps operations teams manage larger portfolios with leaner staff.

This is particularly important for digital‑first lenders and NBFCs targeting high‑volume segments like consumer loans, BNPL, and small‑ticket business credit.

No-Code vs Low-Code in Lending

You’ll often hear “no‑code” discussed alongside “low‑code” in digital lending conversations. Both aim to speed up development, but they target slightly different use cases.

| Aspect | No-Code Loan Platforms | Low-Code Lending Platforms |

| Primary users | Business teams, product managers, operations | Developers plus business teams |

| Development approach | Visual drag‑and‑drop, configuration | Visual tools with the option to write custom code |

| Customization depth | High via configuration and pre‑built modules | Very high, including complex custom logic |

| Typical use cases | Rapid product launch, workflow changes, self‑service journeys | Complex integrations, unique risk models, highly tailored systems |

| Dependency on IT | Lower, mainly for governance and integrations | Moderate; IT still involved for advanced scenarios |

Many lenders use a mix of both, but the broader movement is clear: more control in the hands of business users, less reliance on long IT projects.

Future of Digital Lending with No-Code Platforms

The rise of no‑code loan platforms is tightly linked to broader trends in digital lending: embedded finance, BNPL, API‑driven banking, and AI‑based underwriting.

- As lending becomes more embedded into everyday experiences (e‑commerce, POS, SaaS tools), lenders need the ability to launch and tweak journeys extremely fast.

- No‑code and low‑code tools will increasingly work alongside AI and analytics engines to create dynamic, data‑driven decisioning flows.

Lenders that adopt these platforms early will be better positioned to respond to new business models and regulatory expectations.

Conclusion: Time to Explore No-Code Loan Platforms

Lenders are moving toward no‑code loan platforms because they offer a rare combination of speed, flexibility, cost savings, and control—all without sacrificing compliance or customer experience. From faster time‑to‑market to smoother digital journeys and easier integrations, these platforms are quickly becoming the backbone of modern lending operations.

If your lending business still relies on rigid legacy systems or heavy custom builds, this is the right moment to evaluate a no‑code digital lending platform. Map your current loan lifecycle, identify bottlenecks, and start with a pilot use case—such as a new product or a specific segment—then scale as you see results.

1 reply on “Why Lenders Are Moving Toward No-Code Loan Platforms in 2026”

[…] No-code AML platforms empower non-technical users to design compliance workflows visually. These tools include drag-and-drop interfaces for KYC, AML monitoring, fraud detection, and risk scoring. Fintechs use them to integrate with core banking, credit bureaus, and payment gateways via API-first architectures.[2][3] […]